Market Highlight 17/11/2025

U.S. equities rebounded on Friday after a steep selloff as traders reassessed the likelihood of a Federal Reserve rate cut in December. However, the three major indices ended the week mixed: the S&P 500 rose 0.1%, the Dow gained 0.3%, while the Nasdaq fell 0.5%. The U.S. Dollar Index inched up 0.07% to 99.31. EUR/USD slipped 0.12% to 1.1617.

Gold prices once plunged more than 3% after hawkish remarks from Federal Reserve officials dampened hopes of a December rate cut, triggering a broad risk-off selling trend. Spot gold eventually closed down 2.2% at $4,079.25 per ounce, though it still gained 2% in the week. Oil prices rose more than 2% after a Ukrainian drone strike hit an oil depot at a key Russian energy hub, forcing the shutdown of crude exports from Novorossiysk and reigniting supply concerns.

Key Outlook 17/11/2025

This week marks the first whole trading week since the U.S. government reopened, and a series of economic reports delayed by the shutdown are expected to be released. Market volatility may pick up as the data backlog begins to clear. Investors will closely watch Thursday’s U.S. nonfarm payrolls report, along with key inflation readings from Canada, the UK, the Eurozone, and Japan, as well as the upcoming FOMC meeting minutes, to assess the global economic outlook and the direction of major central banks’ policy paths.

Key Data and Events Today

- 21:30 US NY Empire State Manufacturing Index NOV **

- 21:30 CA CPI YoY OCT **

Tomorrow:

- 08:30 RBA Meeting Minutes ***

- 22:15 US Industrial Production MoM SEP **

Markets Analysis 17/11/2025

EURUSD

- Resistance: 1.1639/1.1669

- Support: 1.1568/1.1544

The EUR/USD held near 1.1600 as the dollar remained directionless, with odds of a December Fed cut slipping below 50% following hawkish remarks. Technically, the pair is stabilizing above the broken trendline and 1.1568 support, with potential to rebound toward 1.1639 if buyers defend the zone. Volatility may increase as delayed U.S. data is released this week.

GBPUSD

- Resistance: 1.3232/1.3275

- Support: 1.3095/1.3051

GBP/USD slipped toward 1.3160 as renewed fiscal uncertainty—following reports the UK may scrap its income-tax hike plan—kept sentiment fragile. Technically, the pair continues to face strong rejection from the descending trendline, with downside pressure building toward 1.3095 if sellers extend control.

USDJPY

- Resistance: 154.87/155.13

- Support: 153.65/153.45

USD/JPY traded sideways around 154.50 as cautious Fed expectations capped dollar strength, while geopolitical tension helped keep safe-haven demand firm. Technically, the pair continues to respect the ascending trendline, with buyers likely to push toward the 154.87 – 155.13 resistance level if the structure holds.

US Crude Oil Futures (DEC)

- Resistance: 61.02/61.82

- Support: 58.49/57.71

WTI hovered near last week’s highs after a 2% surge driven by geopolitical tensions, including Ukrainian strikes on Russian energy assets. However, the price remains capped below the descending trendline, with sellers defending the $60 area. A break back under $58.49 could reopen downside momentum.

Spot Gold

- Resistance: 4161/4204

- Support: 4024/3981

Spot Silver

- Resistance: 52.30/53.36

- Support: 48.92/47.87

Gold bounced back above $4,100 as geopolitical tensions—highlighted by U.S. readiness for potential military action against Venezuela—lifted safe-haven demand. Still, upside momentum remains limited, with Fed officials striking a hawkish tone, and odds of a December cut falling below 50%. Technically, resistance at $4,161 caps gains, with risks tilted toward a pullback toward $4,024.

Dow Futures

- Resistance: 47616/47791

- Support: 46676/46500

The Dow futures slipped 0.65% as selling in UnitedHealth and Visa weighed on the index, with expectations of a Fed cut continuing to fade and valuations sparking caution. Upcoming U.S. data releases—returning after the shutdown—may revive volatility. Technically, the index remains vulnerable below 47,616, with risks skewed toward a drop to 46,676.

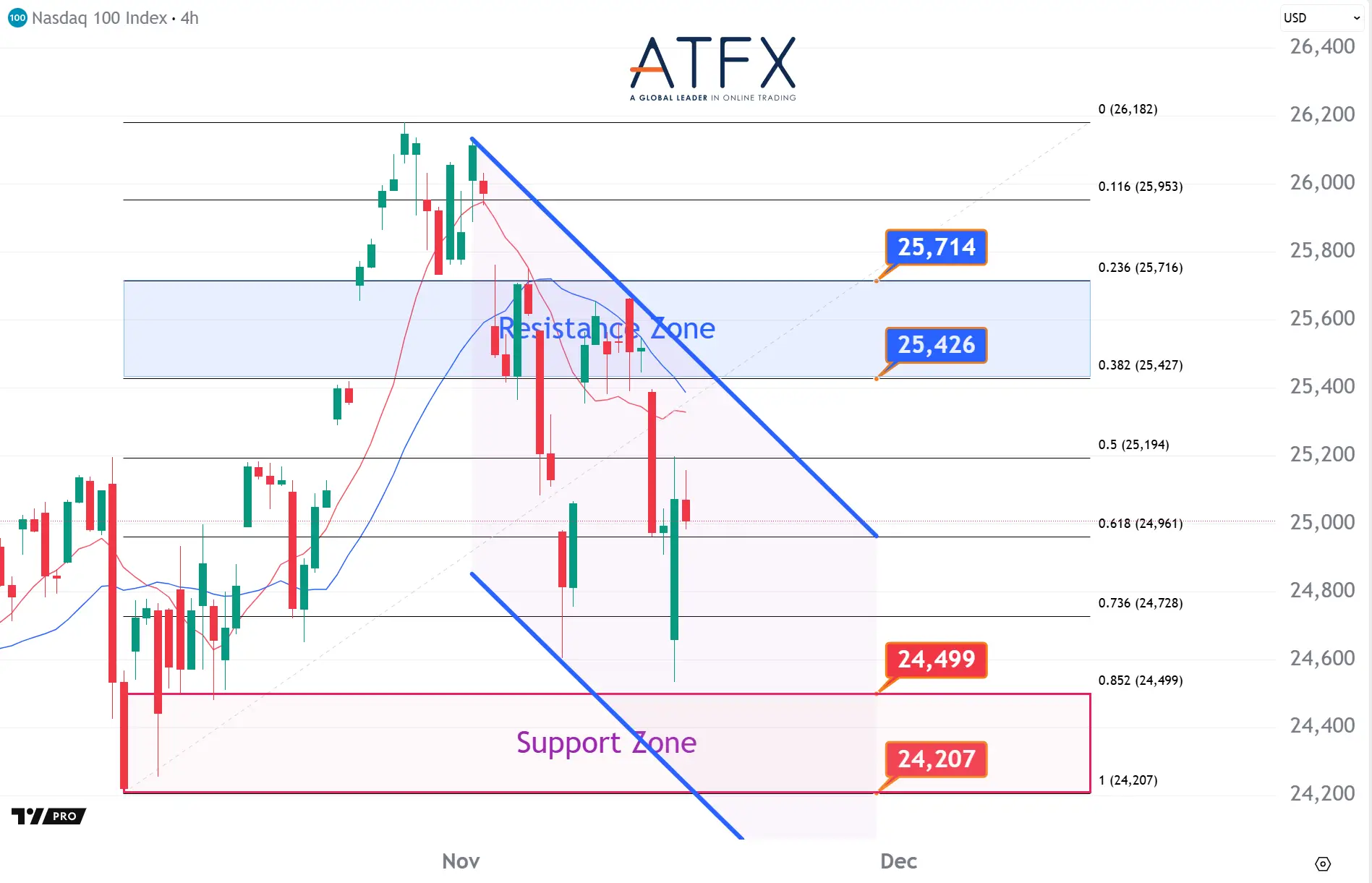

NAS100

- Resistance: 25426/25714

- Support: 24499/24207

NAS100 edged up 0.13%, lifted by tech momentum but still weighed by fragile sentiment ahead of Nvidia’s earnings this week. Markets view the results as a key catalyst for determining whether the AI-driven rally can be extended, especially as fading Fed cut expectations limit risk appetite. Technically, the index holds above 24,499 support, with potential to retest 25,426 if sentiment stabilizes.

BTC

- Resistance: 97898/98898

- Support: 91553/90277

Bitcoin hovered near $95,000 after briefly dipping below $94k, pressured by collapsing Fed rate-cut expectations and weak institutional flows. Technically, the pair faces heavy resistance near $97,898, with the chart showing a likely lower-high formation before retesting the $91,553 support level. The overall sentiment remains fragile amid U.S. data delays and Japan’s plan to tighten cryptocurrency regulation.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.