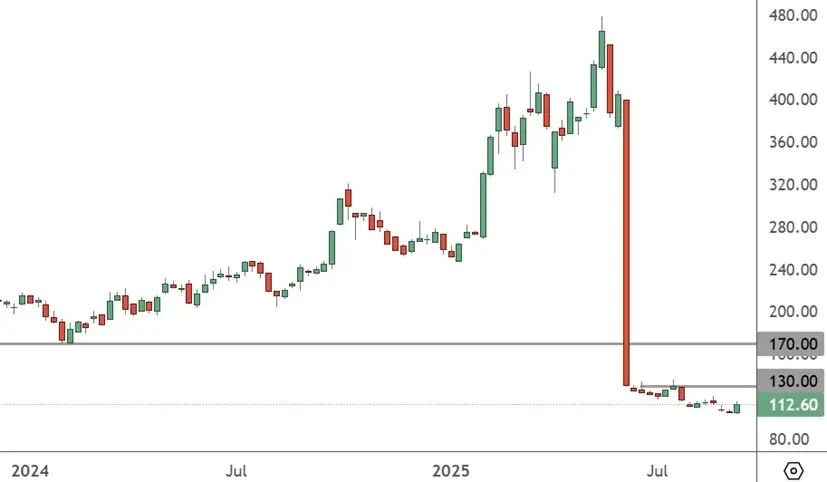

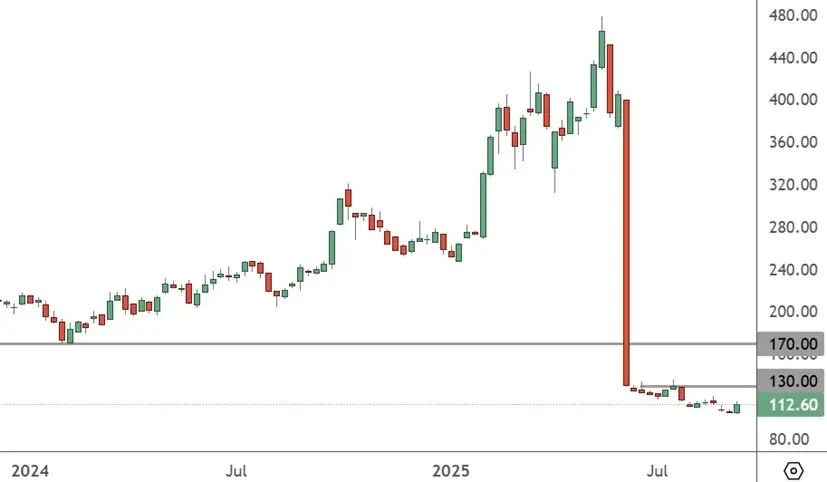

BYD (HKEX: BYD) shares were hit hard in June and face a long road to a full price recovery.

BYD – Weekly Chart

BYD shares slumped below the key 170 level that provided three support tests in the 2022-24 period. That will be the first key upside target and the 130 level is the near-term obstacle for the shares. The June quarter earnings report for BYD popped a bubble of strong performance for the EV maker after a relentless advance where it overtook Tesla as the largest producer. A 30% drop in profits was sufferd from price battles in the sector just as the government took action to curb those tactics. Beijing has taken action over what it calls “involution,” with excess competition driving prices down and hurting the organic growth of the sector. That leaves BYD in a new lane and analysts say the company’s delayed 2025 and early 2026 model launches could add short-term sales pressure. BYD has changed its 2025 delivery forecast from 5.5 million to 4.6 million vehicles, due to competition, but that may be hard to achiveve with another 1.7 million units needed by year-end. One glimmer of hope has been the company’s overseas sales, with BYD projected to deliver up to 1 million units in 2025, beating earlier targets. That doesn’t replace the losses in the company’s core market, and if price wars end, consumer appetite may also slow in the broader EV sector.