The EUR/GBP exchange rate has PMI data for both the European and UK economy on Tuesday.

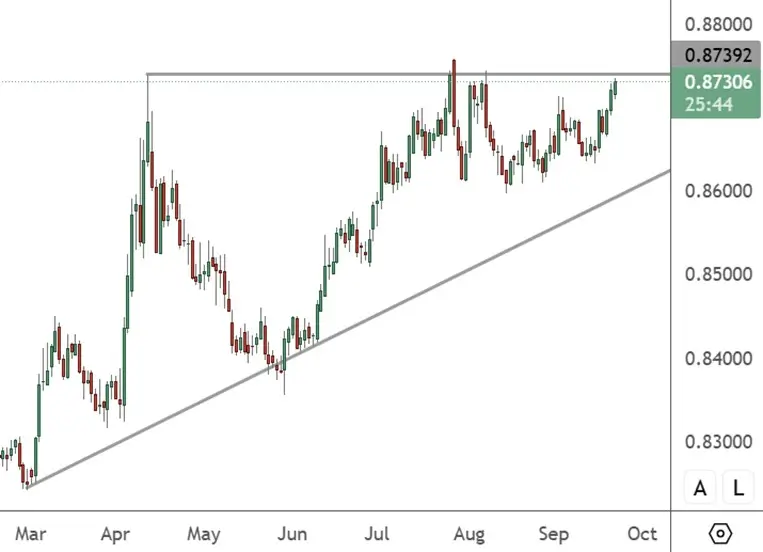

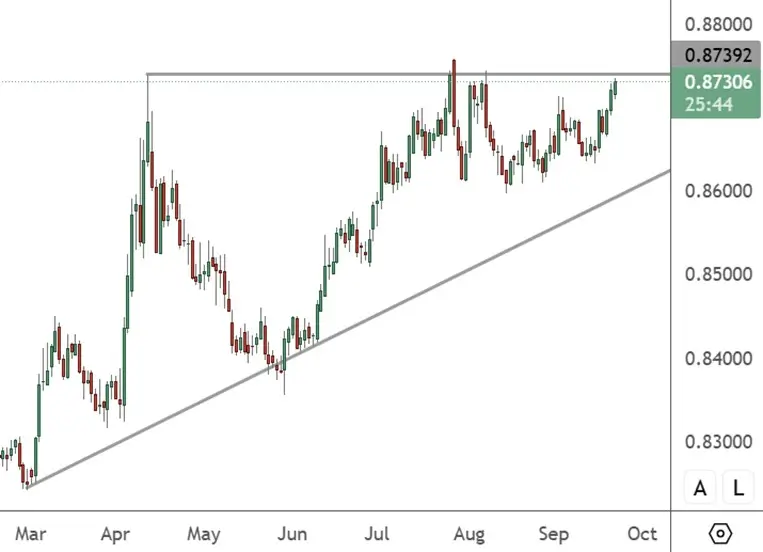

EURGBP – Daily Chart

The EURGBP has strong resistance at 0.8740, which will be a significant test for the rally. A break above could lead to a longer extension of the euro’s recent gains. Data starts at 15:15 pm HKT with the latest French preliminary September data for manufacturing, services and the combined composite number. The same data is then released from the German economy at 15:30, followed by the European data at 16:00, and then the British data at 16:30. Markets are expecting to see a move from 49.8 to 50 for German manufacturing, and a strong number could boost the euro. The European services number is expected to stay the same at 50.5, so anything extra also adds to the euro. The initial French numbers may have more importance than usual in the wake of the recent political changes. Finally, the UK is expected to show a weak 47 reading in manufacturing, similar to the reading it showed last month. Services are also expected to dip from 53.5 to 52.7 for the month. Weakness in the numbers could see further pound selling. The UK Chancellor has delayed the country’s key Autumn budget to late November and will want to see some positive change in the economy ahead of the expected pain of further tax increases. Later in the week, data from the German Ifo institute will also add clarity to the country’s activity. ING analysts noted that European Central Bank members have been relatively silent after the central bank President’s “good place” narrative for the economy. They expect to hear some dovish signals by the end of the year. On UK rates, ING sees the potential for another rate cut in November after Governor Andrew Bailey said that rate cuts should continue, but at a more unpredictable pace. Analysts see the potential for EUR/GBP upside potential into year-end, but with volatility surrounding the November Budget. The euro remains in the driving seat, as interest rates appear to be on hold, and the economy is recovering from its earlier weakness.