今晚,市场主要关注美国4月Markit PMI初值数据的公布。从三月份的数据看,美国经济增长迅速,随着防疫限制逐渐放宽,商品和服务的需求正在快速上升,生产、新订单量、就业人数均显着增长,PMI各项数据从1月的暴跌走向反弹。

步入4月,美国经济仍然在经历着能源、大宗商品、食物等价格的进一步攀升,通胀压力也是前所未有,市场人士普遍对企业成本上升表示担忧。美国4月Markit制造业PMI初值和美国4月Markit服务业PMI初值是否会受到通胀水平的拖累而不及预期,今晚将有答案。

美国市场劳动力仍然吃紧

采购经理人指数是整体经济的重要指标之一,因采购经理人可提前知道公司表现,一般来说50是该指数表现的分水岭,当指数超过50代表行业景气扩张,而50 以下则代表行业衰退步入低迷。对于美国4月Markit制造业PMI初值,目前的市场预期值为58.2,虽然估计值较前值58.8稍低,但是仍然反映商品需求强劲和生产强劲增长,同时商品价格水平在上升。

服务业方面,市场对美国4月Markit服务业PMI初值的预测值为58,与前值持平,而3月数据低于预期。3月Markit综合PMI终值57.7,也低于预期,均反映出成产成本对生产带来的压力。

劳动力就业方面,美国劳工部4月1日数据显示,今年3月份美国失业率环比降至3.6%,非农业部门新增就业人数为43.1万,略低于市场预期,反映出市场劳动力仍然吃紧,或将会拖慢增长速度,尤其是在劳动力缺口最大的服务业。

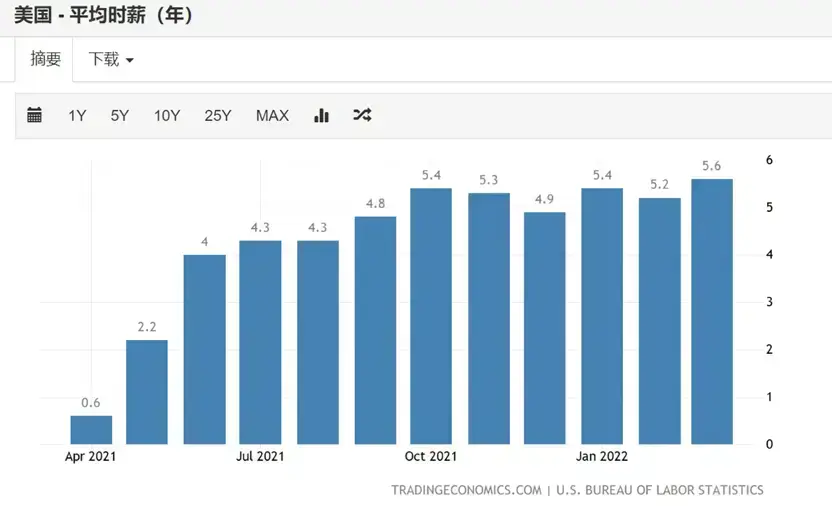

3月份员工平均时薪继续上涨,并且在过去12个月中,员工平均时薪增幅已达5.6%,略高于市场预期,因此通胀形势仍然非常严峻,预计成本的上升会在本月数据中继续体现。

(来源:TRADINGECONOMICS)

Markit服务业PMI指数有下行压力

在过去的3月份,美国制造业与服务业强劲需求推动整体积累订单指数达到 2009 年以来的最高水平,虽然3月的数据显示供应链中断问题得到一定缓解,经济正以较为健康的速度增长,但是目前产能仍然有限,商品供不应求、抬升价格的情况暂时仍无法改变。

在3月一项衡量投入价格的指标加速升至 76.8,接近历史新高,进一步加剧通胀压力,加上劳动力工资上升,企业所承担的生产成本进一步加剧,影响着企业和消费者对经济前景的信心。

由于美国3月经历了通胀爆表,未季调CPI同比上涨8.5%,美联储加息周期开启,市场普遍预计美联储接下来可能会采取更加激进的加息策略以应对飙升的通胀。若加息的陆续到来,也会令接下来数月的Markit PMI指数下行的压力有所增加,供应链产能不足或需要修复的时间较长也会对新订单的生产和交付造成较大压力,同时由于受制于劳动力的缺口,服务业修复也较为缓慢。

市场此前亦担心俄乌战争对美国经济增长及复苏造成拖累,从3月数据上看强劲的商品和服务需求加上疫情限制的放宽抵消了这部分影响,不过由于战争进一步推升能源、原材料、食品价格并且对供应链持续产生冲击,还需密切留意事态发展。