俄乌冲突、美联储紧缩的货币政策,令借贷成本进一步上升,加剧了市场对于需求减少的担忧。今晚,美国4月耐用品订单月率即将公布,市场关注的重点在于本月的预测值相比前值的1.1%大跌过半至0.5%,而扣除运输的耐用品订单月率预计升0.6%。如果耐用品订单量符合预计升幅出现较大收窄,对于美国经济和美元前景意味着什么?

一般来说,耐用品订单数据反映了当前市场的经济状况以及制造业未来的生产承诺,当耐用品订单大幅下降时,可反映出制造业疲软,制造业疲软将会令失业率增加,经济表现较淡;反之,当经济表现蓬勃时,耐用品订单亦会随之而上升。

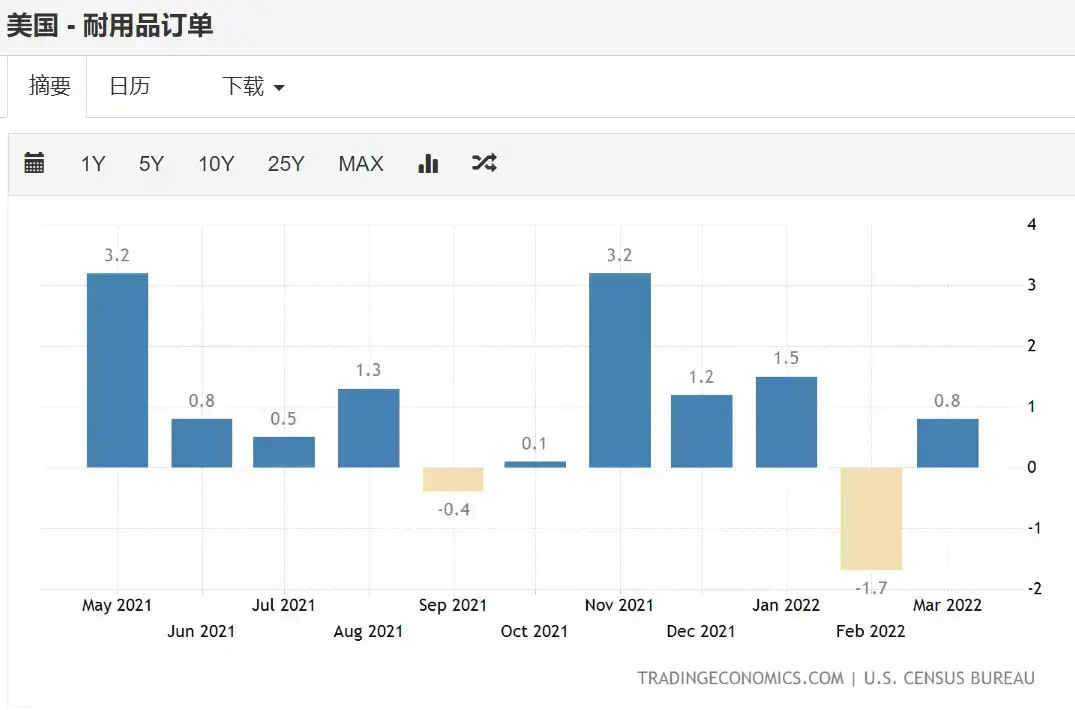

从3月数据上看,美国3月耐用品订单在2月下滑1.7%之后增长0.8%(初值),但是仍为2021年2月以来最低。另外,3月美国工厂订单环比增加2.2%,超出了市场预期。这些数据反映出美国3月的资本支出表现较为强劲,市场需求亦仍然强劲。

然而,昨日公布的美国5月Markit制造业PMI初值为57.5,为3 个月以来新低,反映商业活动出现放缓迹象。分项数据显示,主要受到原材料短缺持续、供应商交货延迟的影响,加上利率上升、生产成本上升,未完成订单指数上升。可见,随着美国通胀达到接近40年高点,美联储通过加息抑制通胀的攀升,也同时增加了美国经济衰退的风险。

美国2022年第一季度实际国内生产总值按年率计算下降1.4%,远远低于预期的增长1.1%,这也加剧了近期市场对美国经济增长放缓甚至出现衰退的预期。有经济学家表示对于当前的加息政策非常担忧,因为会增加投资成本,进一步扼杀经济增长。这一点也反映在了此次耐用品订单预计值大幅收窄,反映出美国当季在新设备方面的商业投资表现不佳。不过,还需要具体看是飞机、工业设备和其他耐用品哪一方面的新订单相比上月大幅减少,以及是否是呈现整体性的下跌。

但是,另一方面也有经济学家预计美国经济有望在第二季度及以后恢复温和增长,主要由于消费支出仍在持续增长,4月美国零售支出季调后环比增长0.9%。

至于美元未来的走势,投资者需要密切留意接下来美联储最新会议纪要的公布,加上制造业和耐用品生产、订单、价格等关键指标的变化趋势,来综合看待宏观经济的走向。

截至目前,美元的发展仍然不明朗,美元指数结束了升势,创下1 月以来最大单周跌幅,刷新盘中低点 102.60附近。未来一系列指标的公布,对于预示经济走向至关重要,也会明确美元的下一步走向。如果数据预示整体经济走向趋于疲软,也可能会继续拖累美元的走势。

另外,由于俄乌之间的冲突,西方国家和俄罗斯之间的制裁对峙仍在持续,加上美联储如果在会议纪要中预示将维持较为激进的加息政策,这些因素均会增加美元向好发展的行情预期。