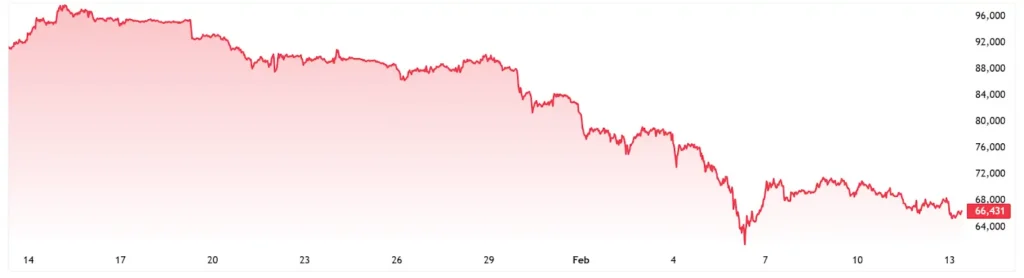

美国就业报告发布后,比特币为何下跌?

周四,比特币下跌2.9%,至65,663美元(截至美国东部时间15:18)。在避险情绪普遍蔓延的背景下,比特币已连续四天下跌。强于预期的美国1月非农就业报告显示,就业增长强劲,失业率持续走低,工资增长稳健。该报告令市场对美联储近期降息的预期落空。交易员目前预计美联储最早也要到6月份才会降息,这给加密货币等风险资产带来压力。比特币隔夜企稳,但未能维持涨势。本月早些时候,比特币一度跌至6万美元附近,但随后止跌回升,并在7万美元下方呈现区间震荡。

加密货币市场数据:ETF、衍生品和波动率

ETF:2月11日,现货比特币ETF净流出2.763亿美元,其中富达的FBTC赎回额最高(9260万美元)。WisdomTree的BTCW净流入678万美元。ETF总资产:857.7亿美元(占比特币市值的6.35%)。累计流入:547.2亿美元。

衍生品:未平仓合约量降至230亿美元(远低于1月/10月的峰值)。较低的未平仓合约量与成交量比率表明杠杆率较高。资金利率略微为正。隐含波动率倒挂预示着短期内的不确定性。

分析师观点:Nexo Dispatch的Dessislava Ianeva表示:“加密货币总市值仍处于区间震荡,波动性较低,市场信心有限。”

高利率持续较长时间通常会对加密货币造成沉重打击。周四高于预期的初请失业金人数加剧了市场的谨慎情绪。周五的CPI报告如今成为解读美联储政策的关键线索。

渣打银行比特币价格预测:5万美元低点即将到来?

渣打银行下调了近期预测,理由是价格走势“充满挑战”。分析师Geoff Kendrick预计:

比特币价格将跌至5万美元或更低。

以太坊价格将跌至约1400美元。

原因:ETF持仓量较2025年10月的峰值下降了25%(比特币数量减少了近10万枚)。约9万美元的平均买入价使投资者面临巨大的未实现亏损,从而引发逢低卖出和逢低买入。长期来看:预计在触底反弹后,比特币价格将在2026年剩余时间内回升。

比特币的挣扎反映了市场在波动性下的谨慎态度。密切关注CPI数据,寻找突破信号。

BlockFills暂停提现:这对加密货币流动性意味着什么

据英国《金融时报》和其他媒体报道,加密货币流动性提供商BlockFills上周暂停了客户提现,以应对当前的低迷行情。

详情:此举旨在保护客户和公司免受压力。现货和衍生品交易仍然受到限制。

规模:服务超过2000家机构。预计2025年交易量将超过600亿美元。

这与加密货币公司在以往市场低迷时期采取的措施类似,表明流动性紧张。