USDCAD could see volatility on Wednesday with US inflation and a Bank of Canada interest rate decision.

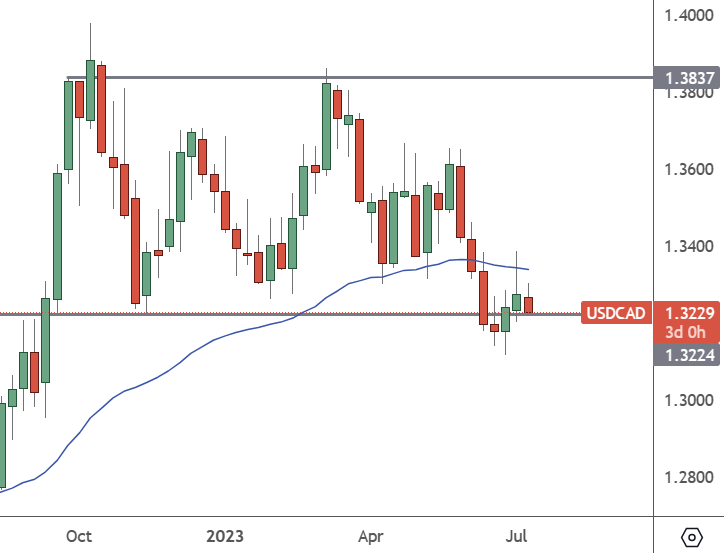

USDCAD: Weekly Chart

USDCAD is probing the support level after a failed attempt to get higher in the range. There is a threat of Canadian dollar strength from here.

Last Friday was a big day for the pair, with a double dose of employment figures. The market now awaits another strong day with US CPI inflation and the BoC.

US core inflation is expected to drop to 5% from 5.3%, and markets will also await the latest official inflation rate, which is expected to drop steeply from 4% to 3.1%. Such a drop could spur dollar weakness and a big rally in stocks.

The Federal Reserve would find it hard to justify two more interest rate hikes if the current level of rates is seen to be having the desired effect on prices.

The Bank of Canada is expected to make another 25 bps increase to its benchmark rate, which would bring the current level to 5%. The country’s largest mortgage lenders see the BoC pausing after this hike.

“They have to sound credibly hawkish,” Benjamin Reitzes, macro strategist at the Bank of Montreal, said. “The door has to stay open for more—they can’t risk a repeat of the post-January move in markets and housing.”

The bank’s decision to pause on January 25 fooled markets into thinking the bank was done. Most economists assumed the country’s highly indebted households had been squeezed enough to cool spending. A rebound in the housing market also boosted consumer confidence and led to a resurgence in inflation. In June, the Bank of Canada increased rates once more, leading to some volatility.

Companies such as the Federal Reserve, European Central Bank, and Bank of England have all committed to higher rates from here.

Another rate increase and a steep drop in US inflation could see the Canadian dollar rally, leading to a drop in the USDCAD through the current support level.