The US dollar index has seen its momentum slow with talk of a Federal Reserve rate cut.

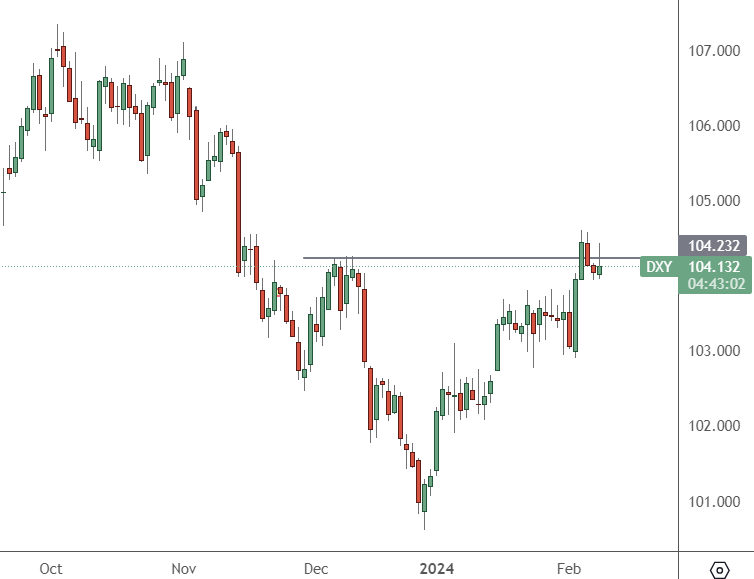

DXY – Daily Chart

The DXY has found resistance against other major currencies at the 104 level.

Next week will be important for the US economy as inflation figures are released. The country’s pricing index is expected to drop from 3.4% as it approaches the Fed’s 2% target.

Retail sales will also be released for the US economy. In contrast, inflation and GDP for the UK economy could make the GBPUSD the most volatile pair.

A top Fed official has said the country’s strong labour market is starting to cool. This indicates that last month’s substantial employment numbers will not hurt policymakers’ plans to cut borrowing costs this year.

Loretta Mester, president of the Cleveland Federal Reserve, said last week’s jobs report for January showed the labour market was “remarkably resilient” — but other indicators pointed “to some moderation”.

“At this point, I suspect we will see further moderation of wage growth, with a gradual slowing in job growth and an uptick in the unemployment rate over the year from its very low level,” she said.

Mester said her “base case” was for the Fed to cut the federal funds target from a 23-year high of 5.25% to 5.5% “at a gradual pace” in 2024.

“If the economy evolves as expected, I think we will gain [the confidence to cut] later this year, and then we can begin moving rates down.”

Governor Michelle Bowman, seen as a more hawkish member, said last week that the January data provided evidence that the jobs market could lead to services inflation remaining above the central bank’s 2% goal. Data for January’s non-farm payrolls, an essential measure of the job market, showed 353,000 jobs were created last month, almost double analysts’ forecasts.

Another policymaker, Susan Collins, said this week that the US central bank would likely cut interest rates by three-quarters of a percentage point this year, starting once inflation shows another leg lower toward 2%. “I do expect that before the end of the year, it will be appropriate for us to carefully begin easing rates,” Collins said

Despite the outsized number, markets are not driving the US dollar. They will wait for some inflationary weakness to show up.