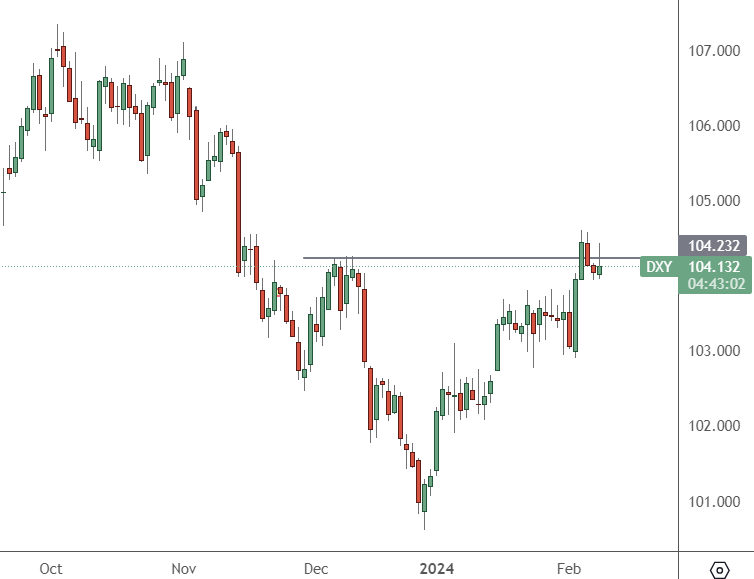

隨著下週通膨數據公佈,美聯儲(Fed)降息的傳言,美元指數的勢頭放緩。

DXY – 日線圖

美元指數兌其他主要貨幣在 104 水準遇到阻力。

下週對美國經濟來說非常重要,因為通膨數據將會公佈。該國的物價指數預計將從 3.4% 下降,接近聯準會 2% 的目標。

美國經濟零售銷售數據也將公佈。相較之下,英國經濟的通膨和國內生產毛額可能使英鎊兌美元成為波動性最大的貨幣對。

聯儲局一位高級官員表示,該國強勁的勞動力市場正開始降溫。這表明上個月的大量就業數據不會損害政策制定者今年削減借貸成本的計劃。

克利夫蘭聯邦儲備銀行行長洛雷塔·梅斯特表示,上週的一月份就業報告顯示勞動力市場“非常有彈性”,但其他指標顯示“有所放緩”。

「在這一點上,我懷疑我們將看到工資成長進一步放緩,就業成長逐漸放緩,失業率從非常低的水平開始上升,」她說。

梅斯特表示,她基本預期美聯儲會在 2024 年內逐步將聯邦基金利率從 2023 年來的高點的 5.25% 至 5.5%下調。

“如果經濟按預期發展,我認為我們將在今年晚些時候獲得[降息的信心],然後我們就可以開始降低利率。”

被視為更鷹派的行長米歇爾·鮑曼(Michelle Bowman)上週表示,1月份的數據提供了證據,表明就業市場可能導致服務業通膨率保持在央行2%的目標之上。 1 月非農業就業數據(就業市場的重要指標)顯示,上個月創造了 353,000 個就業崗位,幾乎是分析師預測的兩倍。

另一位政策制定者蘇珊柯林斯(Susan Collins)本週表示,一旦通膨率再次下降至2%,美國聯準會 (Fed) 今年可能會降息四分之三個百分點。柯林斯表示:“我確實預計,在今年年底之前,我們應該謹慎地開始放鬆利率。”

儘管數量龐大,但市場並未推動美元上漲。他們將等待通膨數據疲軟的顯現。