According to the UK data released yesterday by the Office for National Statistics, the UK Consumer Price Index (CPI) rose to 10.1% annually, against the forecast of 9.8% and marking a 0.7% increase from the previous record of 9.4% in June.

The Core inflation rate, which excludes energy, food, alcohol, and tobacco prices, rose to 6.2% in July against the previous record of 5.8% in June.

While other countries’ inflation, especially in the US, seemed to have slowed down massively in July due to the significant fall in oil prices. However, the UK inflation rate maintained upward movement to create a double-digit record in July at 10.1%. This shows that the depth of inflation in the economy goes much beyond the rising energy cost to embrace other factors, especially food costs within the economy.

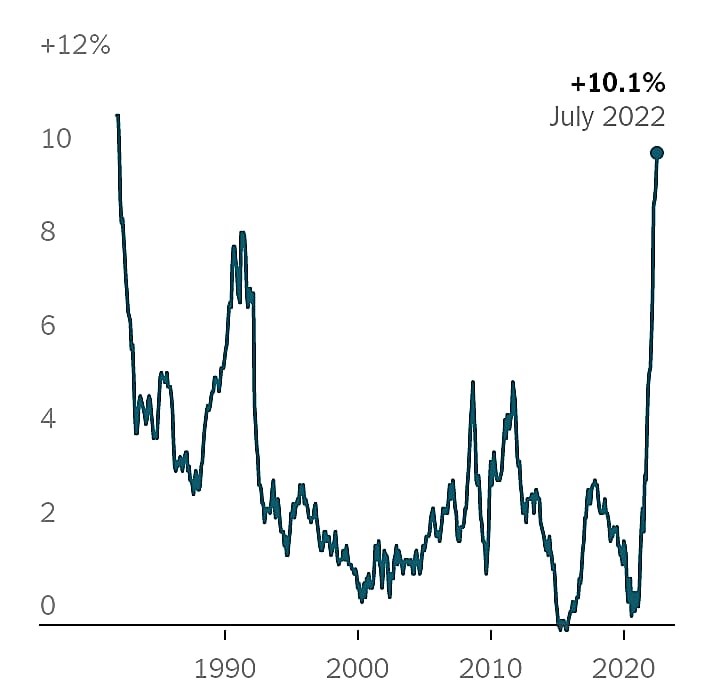

Diagram of UK inflation rate for up to July 2022

Source: Office for national statistics

The jump in the UK inflation rate came as a shock to analysts who forecasted a slow down in its inflation rate in July due to the lower energy costs all through July. The report further heightened the fears of an imminent recession likely to occur in the economy.

The series of interest rate hikes by BoE has not yet significantly impacted the economy. This suggests that a more aggressive interest rate hike above this level would be necessary to control inflations. Here, many analysts believe that an entire point increase just like Canada did previously; remains the most appropriate to salvage the situation at the moment.

Nadhim Zahawi submitted that the government has been working on reducing inflation from high energy costs and would continue its efforts until the inflation rate is contained.

The inflation report showed that price pressure came from other areas besides oil. For instance, food prices rose to 12.6% marking their highest level since 2008.

Hotel prices rose by 9% in July, marking their highest level in 30 years. The retail price inflation rate rose to 12.3%, keeping its highest level since 1981.

The BoE still believed that rising energy cost remains the primary cause of the high inflation rate. Allowing this to continue would likely push the nation into a recession sooner than expected.

Amidst the high inflation rate, some analysts tend to figure out the possibility of slowing down the UK inflation rate in the coming months. The support was derived from the decline in prices paid by factories in the UK. This portion fell to 22.6% in July against the previous 24.1% in June.

Added to this, economists observed that commodity supply prices have started to decline globally, which could control the rising inflation rate, especially in the UK.

Some believe that UK inflation has not peaked and is likely to experience more upsides when household energy bills are expected to rise more. The UK economy could suffer a prolonged recession from high energy prices during this period. The occurrence would result in more decline in consumer spending and reduce industrial productivity based on low demands. Here, the BoE expects inflation to peak in October at 13.3%.

Notwithstanding a 4.7% rise in worker’s pay, the cost of living has by far exceeded wage growth and squeezed household incomes as the prices of most goods and services were found to have doubled in the UK within the last two years.

The high inflation rate has created more work for the BoE, fighting inflation. With the bank placing its inflation target at 2%, then more aggressive interest rate hikes would be expected from the committee to achieve half of this target, given the high rate of inflation witnessed in July.

So far, the BoE has carried out six successive interest rate hikes since it began its tightening monetary policy to fight inflation. The bank had initially maintained 25 basis points hiking for the first five months but had to increase the pace to 50 basis points in June. With the higher records of inflation witnessed in July, they would likely increase the pace during their next session in September.

However, the risk of a possible recession has become the most significant challenge withholding the committee from embarking on excessive interest rate hikes.

What impact will the high rate of UK inflation have on the British Pounds?

The high inflation rate in the UK will probably attract a short-term buy for GBP ahead of the monetary policy committee session in September. However, the interest rate for GBP is way below the USD; more investors would be attracted to the USD than the GBP. Both countries would be expected to hike their interest rates in September. Hence, the most aggressive side would dominate the other over the long period of global tightening the monetary policy. The current interest rate for USD is 2.5%, while the rate for GBP is 1.75%.

Investors often pay great attention to these rate differences when choosing the currency to invest in. This is also one of the significant reasons why GBPUSD had been on a downward trend, with the dollar leading the way against other currency pairs matched with it.

Traders are advised to pay attention to the interest rate differences in all the major pairs while taking positions in the market each time the inflation report is released.