The price of silver has broken out of a long-term range and has the potential to test higher levels.

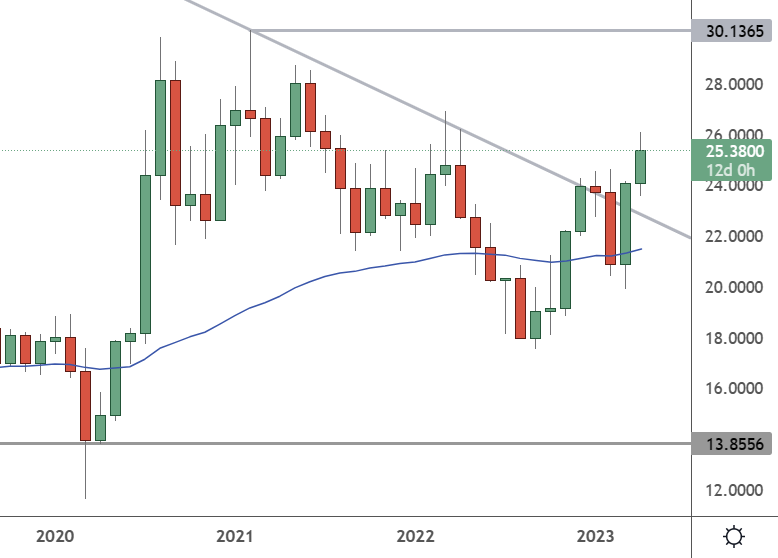

XAGUSD – Monthly Chart

The price of XAGUSD has broken out from a downtrend at $24 and has the potential to target $30, which was the 2020 high.

The price of silver has been following the price moves of other commodities. However, silver is showing a need for more supply in the physical.

Intense demand for physical silver is creating a shortage in the market, according to a CNBC report earlier this year. Industrial users have no choice but to pay higher prices without alternatives to white metal. Investment interest is also spiking in silver because of the higher price of gold.

Silver Gains Market Popularity (XAGUSD)

“Silver is giving better returns than gold and hence investors are putting their money on this metal. Though 70 percent of silver is used in industrial production, still the returns are good,” Jayantilal Challani told IANS.

Silver demand has increased from 950 million ounces in 2017 to 1,101 million ounces in 2022, according to Statista.

Gold prices have risen as investors look for safety due to the banking turmoil in the USA, the threat of extended war in Ukraine, and heightened tensions between China and Taiwan.

Another boost for the price of commodities has been the decline in the cost of the US dollar. The dollar index has dropped from highs above 112.50 in 2022 to 101.58. That could be a headwind for silver and gold if investors move back to the US dollar.

Traders can see the breakout on silver on the monthly and move down the timeframes to chase the trend higher.