US oil prices have been in a normal range since late-2022 as crude looks for a real catalyst to breakout.

The Chinese reopening theme has not spurred a significant price rally in oil prices, and traders are looking ahead to OPEC.

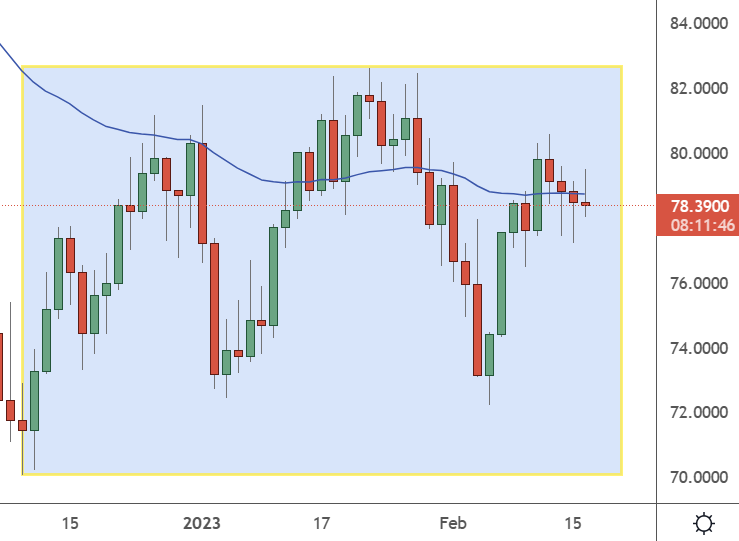

USOIL – Daily Chart

USOIL has been trading in a range encompassing the $70 and $82 levels as support and resistance. With a current price of $78.39, the bulls are in charge, but the weakness in stocks is weighing on oil.

China is expected to drive oil consumption to record levels again this year as the world’s second-largest economy reopens following covid lockdowns. The International Energy Agency has predicted that oil demand will grow to 101.9m barrels a day this year, fuelled almost entirely by increased demand from Asia.

That has led to expectations that oil prices will stay robust through the year. However, the price is still struggling to maintain the $80 per barrel level in the first quarter of 2023. The IEA’s prediction for oil demand is 200,000 barrels a day more than they had forecast last month. The agency predicts that more than two million barrels per day of annual growth this year and 1.4m barrels will be driven by Asian nations. According to the IEA, China alone will account for 900,000 barrels daily, almost half of the entire year’s growth.

With the Chinese demand play now priced in, traders may consider OPEC a driver of higher prices. The group indicated it would stick with its production quotas fixed late last year for the rest of 2023, even as China’s economy reopens and Russia cuts output.

On Tuesday, UAE Energy Minister Suhail Al Mazrouei said that crude markets are balanced. Rising demand in some regions is countered by a slowdown elsewhere.

“Key to oil demand growth in 2023 will be the return of China from its mandated mobility restrictions. Concern hovers around the depth and pace of the country’s economic recovery.”

OPEC may be critical to oil prices in the year ahead as they will adjust production compared to economic growth. A more robust Chinese and US financial picture would spur demand, while a predicted slowdown could see production slashed.