US crude oil prices have woken from a slumber in 2023 to hit 10-month highs.

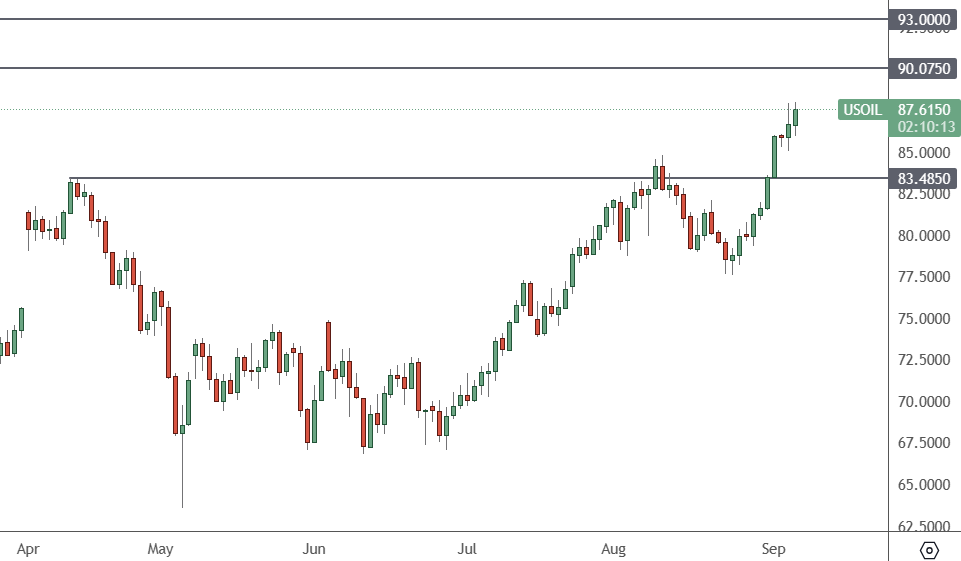

USOIL: Daily Chart

USOIL surged in the last two weeks to trade at $87.61. The next targets for oil would be $90 and $93.

Oil prices spiked after Saudi Arabia and Russia said they would continue their oil production cuts into the end of the year. Riyadh’s decision to extend its 1 million bpd voluntary production cut will be reviewed monthly to see whether to deepen the cut or increase production, state news agency SPA said.

Any resurgence in inflation could lead to the Federal Reserve adding more interest rate hikes. According to the CME FedWatch Tool, futures markets are currently pricing in no further interest rate hikes for this cycle and a potential interest rate cut by May 2024.

Federal Reserve Governor Christopher Waller told CNBC on Tuesday that the Fed can “proceed carefully” with further interest rate hikes. “There is nothing saying we need to do anything imminent,” he said of additional increases due to the recent economic data he has seen.

Fellow OPEC+ member Russia has also prolonged its voluntary production cuts through the end of the year “to maintain stability and balance” on oil markets, the country’s Deputy Prime Minister Alexander Novak said. The world’s second-largest oil exporter is reducing exports by 300,000 bpd and has been cutting output and exports with Saudi Arabia on top of existing OPEC+ supply reductions.

Russia said previously it would cut oil exports voluntarily by 500,000 bpd, or about 5% of its output, in August and by 300,000 bpd in September. Although Saudi Arabia was widely expected to extend its voluntary cuts into October, and Russia had indicated it would follow, the extra three-month extension took markets by surprise.

“It would appear they’re trying to double down and capitalise on the recent price moves. Put a big buffer in place for when the cuts end,” analyst Craig Erlam told Reuters.

Central bankers will now be watching oil more closely after a recent slump helped reduce inflation.