The price of gold has attracted buyers after the Federal Reserve kept its benchmark interest rate on hold.

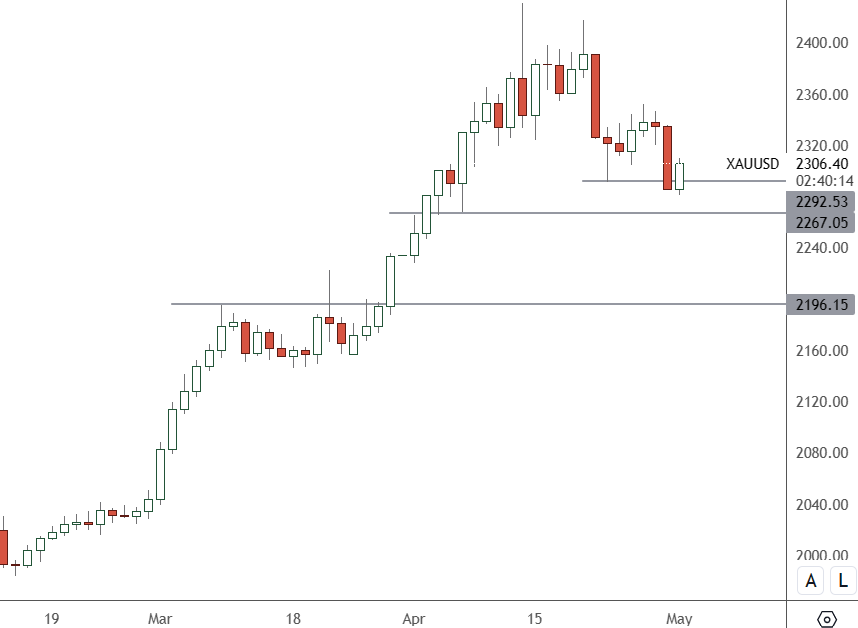

XAUUSD – Daily Chart

The price of gold was higher after the Fed policy decision. A price bottom at the $2,267 level could again target the $2,350 level.

The latest report from the World Gold Council said that demand, including extensive over-the-counter (OTC) buying by investors, was 3% higher year-on-year to 1,238 tonnes. The group said that marks the strongest first quarter since 2016 on Tuesday.

According to WGC’s Q1 2024 Gold Demand Trends report, demand, excluding OTC, slipped 5% year-on-year to 1,102t in the first quarter due to continued ETF outflows.

In the physical market, global jewellery consumption was 2% lower year-over-year at 479t, which WGC said was “healthy, given the price rally.” Technology demand for gold also recovered 10% y/y as the AI boom boosted demand for electronics.

According to the report, mine production was 4% higher yearly to 893t. Barrick Gold, the world’s second-largest miner, beat Wall Street expectations for its first-quarter earnings and said it was on track to achieve 2024 targets.

Another reason for selling this week was the speculation of ceasefire talks between Hamas and Israel. That means that demand from institutions is lower.

Russia and China’s central banks have also been keen buyers of bullion. Given their strained relationship with the US, they are increasingly wary of buying US treasuries and have been moving to gold.

The World Gold Council says central bank buying was at its second-highest level on record during 2023. The Financial Times reported that the banks bought around $155bn of gold between September 2020 and December 2023.

Investors can keep an eye on Wednesday’s close in gold and see if there is a potential bottom in place for the price of gold.