The price of gold dipped on Wednesday after the precious metal touched a new all-time high.

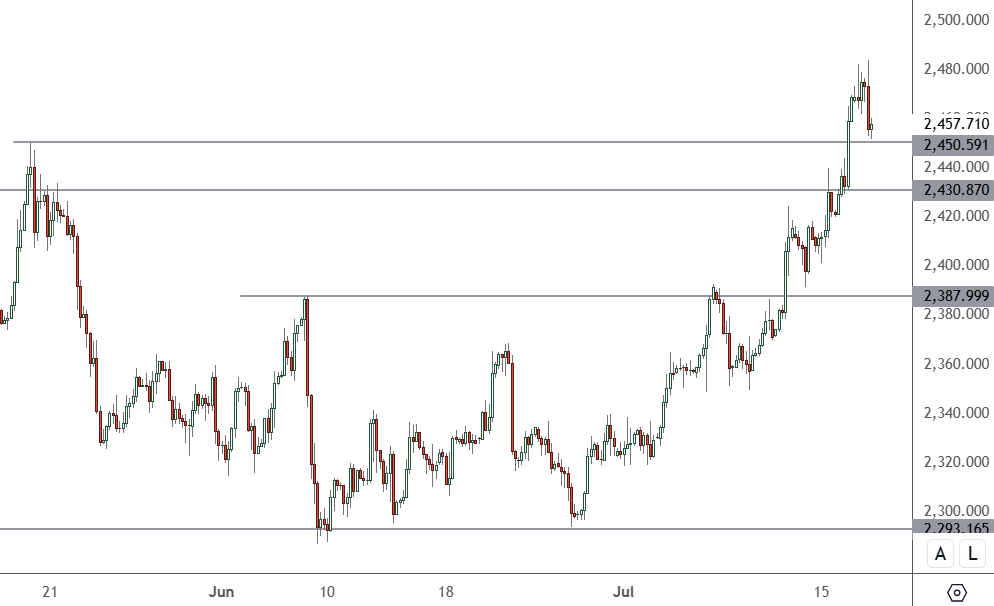

XAUUSD – Daily Chart

The price of XAUUSD was lower by -0.46% on Wednesday after touching a new all-time high near $2,480. The previous high at $2,450 will be the initial support level to watch.

Gold was lower after setting another record on Wednesday as traders upped their Federal Reserve rate cuts bets.

On Wednesday, Fed Governor Christopher Waller said the economy was getting closer to a level where the central bank can reduce borrowing costs. However, he indicated he’d like to see a “bit more evidence” that inflation is moving lower.

Waller joins a list of officials who have signalled they are moving closer to cutting rates. However, most, including Fed Chair Jerome Powell, have stopped short of offering a specific timeline. Markets now see a 98% chance of a US rate cut in September, according to the CME FedWatch Tool.

Gold has gained nearly 20% this year, supported by large purchases from central banks, robust consumer health in China and demand for haven assets due to geopolitical tensions. Momentum traders are re-emerging as a critical driver of gold prices amid a more bullish environment.

“The expectation that we are getting closer to a Fed interest rate cut and we’ve seen this as yields continue to slowly grind lower in anticipation, that, along with a weaker dollar, are the main supportive factors behind this gold move,” said David Meger at High Ridge Futures.

Thursday, there is an interest rate meeting from the European Central Bank, which can potentially drive the US dollar and gold.

Euro rates are now pricing in 48bp of cuts for 2024, which is just short of two total 25bp cuts. A third cut in October is unlikely, given that the European Central Bank is pacing its quarterly projections. Governing Council member Klaas Knot noted his earlier preference for sticking to quarterly rate-cutting decisions to view updated economic forecasts. A 50bp cut in a single meeting is similarly unlikely as inflation numbers remain stubborn and recession risks remain low.