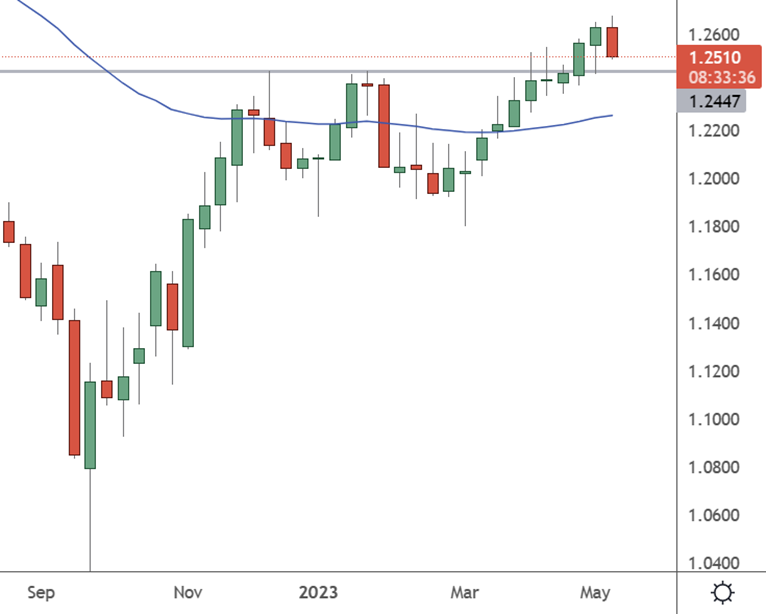

GBPUSD is testing the recent breakout of the 1.25 level on a weekly basis after a week of important UK data.

GBPUSD – Weekly Chart

The price of GBPUSD trades at 1.2510 and a continuation of the uptrend would target 1.30 and above versus the US dollar.

The Bank of England raised interest rates again on Thursday in a widely expected move with a 25 basis point hike from 4.25% to 4.5%. The European and US central banks both hiked rates over the last week and the UK was predicted to follow. Inflation has been more stubborn in the UK and is up near the 10% level.

Further data on Thursday from the US showed producer prices rising less than expected in another sign the UK is worse off on inflation. The US dollar has been under some pressure, which may continue in the coming weeks if the country’s debt ceiling agreement is not fixed.

GBPUSD Forecast

The bigger data from the UK was on Friday with GDP for the three months to the end of April being released. A year-on-year number of 0.2% growth came in as expected, down from 0.6% previously. However, analysts are expecting the UK to escape a recession in the coming year.

Meanwhile, there are fears for the housing market with UK house prices rising only 0.1% in April, for the smallest increase since December 2012. There were also concerns from the private sector as profit warnings from construction firms and a gloomy outlook from the online estate agent Purplebricks, led to sharp falls in their share prices.

A day before its annual investor meeting, Marshalls, which produces landscaping, building and roofing products, warned that sales had fallen by 14% year on year to £227m in the four months to 30 April.

Despite some economic gloom, the pound can still look for support at the 1.25 breakout level and move higher after another rate hike and some US debt ceiling fears.