EURGBP will provide volatility for traders with three days of economic data.

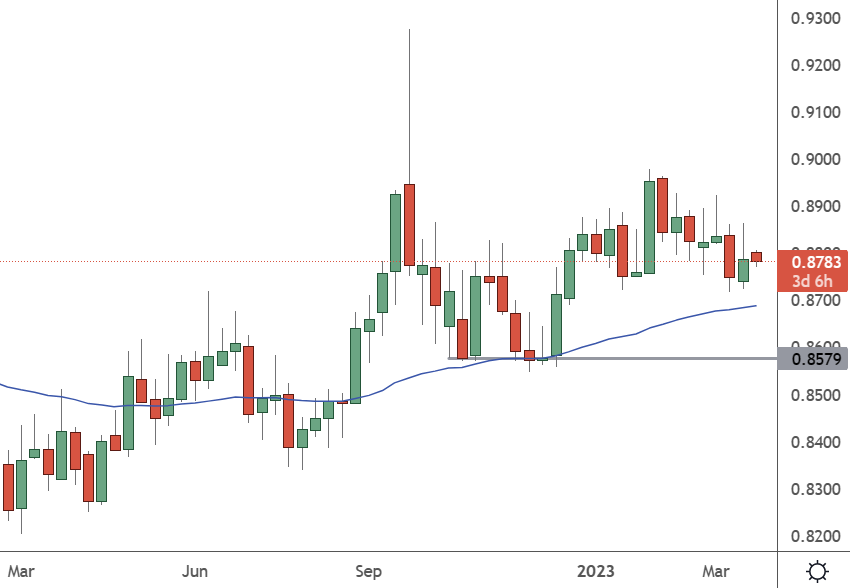

EURGBP – Daily Chart

EURGBP has support down to the 0.8580 level if the data supports the euro.

Wednesday has Gfk consumer confidence for Germany on Wednesday, with traders expecting a small move to 29.0

Thursday has a more critical inflation number for Germany, with a sharp drop expected to 7.3% from 8.7%.

The number would confirm that western inflation is slowing after central banks’ recent interest rate hikes.

German Inflation Data vs. British GDP Report

Friday will have the latest GDP figures from the British economy, with 0.4% growth expected for Q4 in the UK. German employment on Friday is expected to see jobs flat after only 2k added in the previous month.

S&P reported that German business activity was higher in March, with inflation falling but still elevated due to services price pressures. This was due to “growing wage demands and rising borrowing costs,” the group said. The situation differed in manufacturing, where softer raw materials and energy prices led to the most significant price drop since May 2020.

IMF chief Kristalina Georgieva warned this week that there was a threat to the world economy after the recent bank collapses. Georgieva said rising interest rates had put pressure on debts, leading to “stresses” in leading economies, including among lenders.

Georgieva added that the world economy would grow by only 3% this year as rising borrowing costs, war, and covid continue to hurt growth.

“At a time of higher debt levels, the rapid transition from a prolonged period of low-interest rates to much higher rates – necessary to fight inflation – inevitably generates stresses and vulnerabilities, as evidenced by recent developments in the banking sector in some advanced economies,” Georgieva said.

The European Central Bank is also fearful of problems in the banking sector. Vice President Luis de Guindos told the Business Post that lower growth and inflation could result.