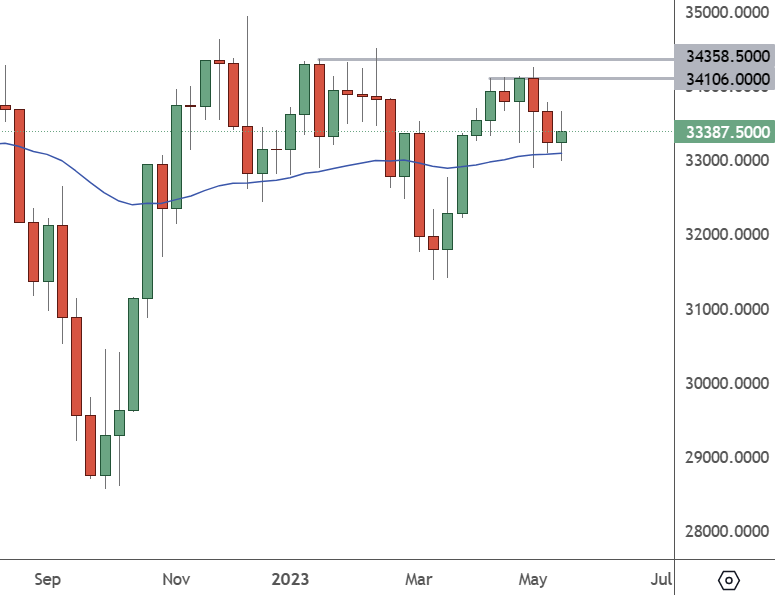

US30 closed the week around the 33,580 level and could gap lower in early Sunday trading.

US30 – Weekly Chart

Negotiations in Washington over the US debt ceiling moved backwards, with the White House and House Republicans unable to reach an agreement. Republicans have been looking for significant spending reductions, arguing that Congress needs to bring spending back to 2022 levels and avoid further problems. The White House wants to achieve policy goals via additional taxation.

Republican leader Kevin McCarthy said there’s potential for extending the debt ceiling until 2025. However, he added that he wants cuts to federal spending. McCarthy said Joe Biden demands tax increases after an earlier agreement to avoid that path.

“President Biden doesn’t think there is a single dollar of savings to be found in the federal government’s budget,” McCarthy said. “He’d rather be the first president in history to default on the debt than to risk upsetting the radical socialists who are calling the shots for Democrats right now”.

Dow Jones Index Market Outlook

The situation could escalate this week with only ten days until the default deadline. That could bring volatility to the US stock market and the currency market. The key economic data release will be Wednesday’s FOMC meeting minutes.

Fed Chair Jerome Powell said the Federal Reserve would likely avoid another interest rate increase when it meets in June. That would be a boost for the market, but the debt ceiling is currently controlling the story.

“Having come this far, we can afford to look at the data and the evolving outlook and make careful assessments,” Powell said.