The U.S. dollar could face further pressures this week against other global currencies as the Federal Reserve meets to decide on interest rates.

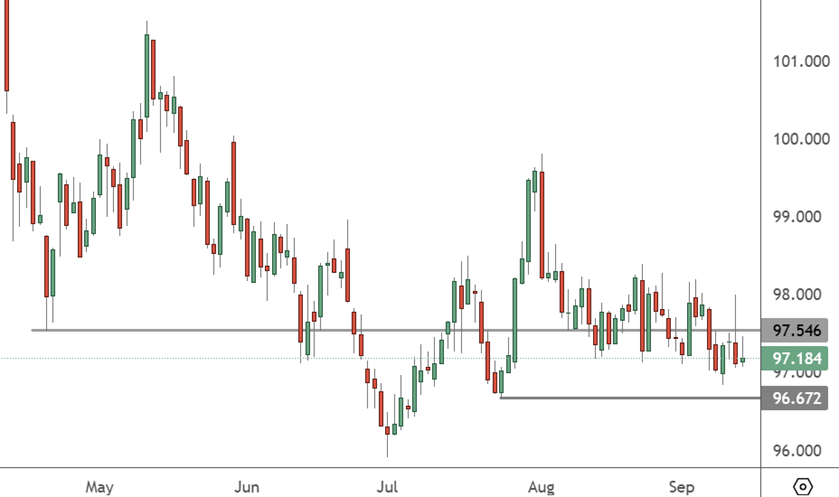

USDX – Daily Chart

The USDX saw early gains last week but surrendered them to close below 97.50 once again. The next target would be 96.72 on the downside.

The dominance of the US dollar in global trade looks unlikely to change any time soon, according to Gita Gopinath, former IMF Chief Economist.

“What is critical to the dollar’s dominance in the world are the strength of its institutions, the depth and liquidity of its financial markets, and the law and order in the country,” she said in a recent IMF Podcast. “As long as those remain, the dollar will keep its status for a long time”.

In the short-term selling continues and the dollar is struggling to find buyers at the recent lows.

“The broader picture is still quite negative for the dollar on a variety of measures,” said John Velis at BNY in New York. “One, of course, is the Fed now beginning to cut rates. The other is, we still see hedging behavior taking place, so foreign investors buying U.S. assets and selling the dollar to hedge it, which is going to keep pressure on the dollar”.

Attention now turns to the Federal Reserve’s interest rate decision this week and that will be a key driver. The dollar could see further weakness if the Fed projects a series of rate cuts before year-end.