EURCAD to face a release of data on Wednesday and could define whether the Canadian dollar can stage a rebound in price.

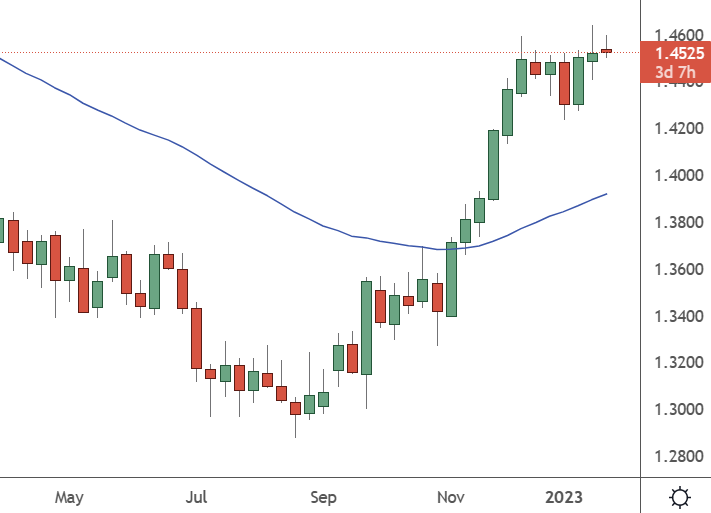

The euro versus the Canadian dollar hit resistance at the 1.46 level after the recent rally, which could lead to a pullback in the pair.

EURCAD – Weekly Chart

German data on Tuesday showed consumer confidence coming in slightly higher than expected. Consumers are still concerned about higher inflation and are being squeezed by inflation and lower wages. Tomorrow will see the latest IFO business climate figures, with a move from 88.6 to 90.2 expected.

Recent Canadian jobs and inflation data have suggested that a soft landing remains within reach. The Bank of Canada will meet to decide on interest rates this week, and history would warn against making any hasty relaxing of tighter monetary policy.

There are clear signs that price pressures are easing in Canada, with inflation on track to fall below 4% within a few months from 6.3% in December. The recent jobs data showed a solid return of 104,000, suggesting that any downturn could be mild.

There’s a possibility that Canada could experience a mild recession which is strong enough to slow inflation but not too strong to hurt the employment picture. However, that may depend on whether the BoC stays the course and goes for a quarter-point hike.

The central bank will also release revised inflation forecasts this week, and that could be a driver of gains in the CAD. Another boost for the Canadian dollar could come from the oil price after a recent bottom in crude.

The recent talk of a Chinese reopening has boosted crude oil, and hedge fund managers have been moving into crude oil futures. Investment funds purchased 89 million barrels of petroleum contracts over January 17. That trend could pick up steam over the coming months as China and other Asian nations reopen their economies. Lower inflation data has helped the price of crude, and Wednesday will see the latest inventories from the US.

An OPEC production cut could also be possible with oil near $80 as some analysts believe they have a target of $80-90. That could see them cut to boost prices in anticipation of higher Chinese demand later in the year.