The AUD/USD exchange rate has a big day ahead on Monday in a strong calendar week for the United States.

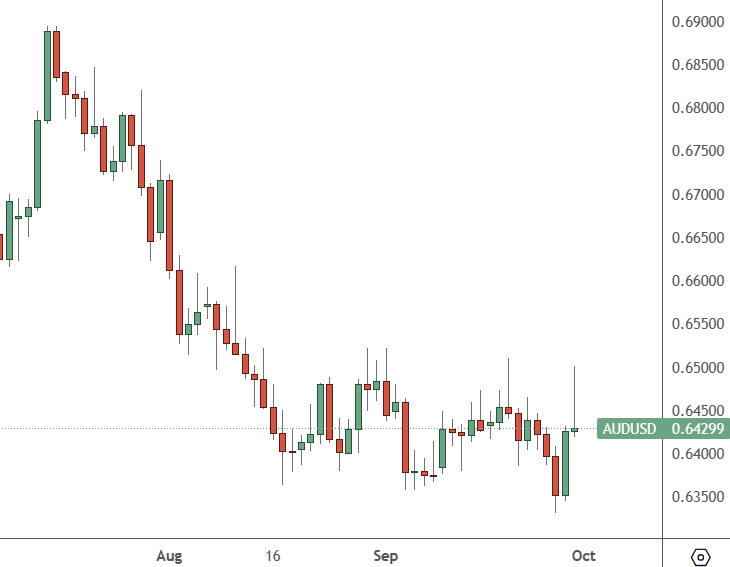

AUDUSD: Daily Chart

AUDUSD rallied on Thursday and Friday from support but gave up some of the Friday gains. Traders should look for a possible rebound if the pair gains traction from the data.

Monday will start with the important ISM manufacturing data for the US in September.

Last week saw a slowdown in durable goods orders, such as plant and machinery, and the latest ISM is expected to show a modest 0.1 improvement on last month. The figure is also below the 50 level, which signifies expansion in the industry.

Data on the property sector in the US was gloomy last week, with a plunge in new home sales pending. Mortgage rates soaring to 20-year highs have hurt the appetite for property.

The Australian economy will see another Reserve Bank interest rate decision ahead of Tuesday’s session, and comments from central bankers could drive the Aussie direction.

Australia’s central bank is expected to hold rates steady for a fourth straight meeting next week.

“The Australian household is the most impacted by policy rates that it’s ever been,” said Robert Mead, co-head of Asia-Pacific portfolios for PIMCO. “That’s why policy is likely to get more traction here than in the US.”

Westpac Bank calculated that over 90% of new Australian home loans are on floating rates, compared with the US, where a majority are fixed for 30 years. That puts the effective mortgage rate at 5.6% from 2.75% in Australia, compared with 3.6% from 3.3% in the US. That has an extra headwind for the Australian consumer and its economy.

“Excess savings are being eroded incredibly quickly,” Mead said. “We’re in the epicentre of the switch to floating-rate mortgages from fixed-rate ones.”

Retail sales for August also came in weaker than expected with consumer sentiment already in the doldrums.

“The upward surprise in inflation through August does put some upside risk on inflation in the third quarter as well as the rest of the year,” said Adelaide Timbrell, economist at ANZ.