Apple released its iPhone 15 at its Cupertino, California, headquarters, and investors will be watching the stock’s reaction.

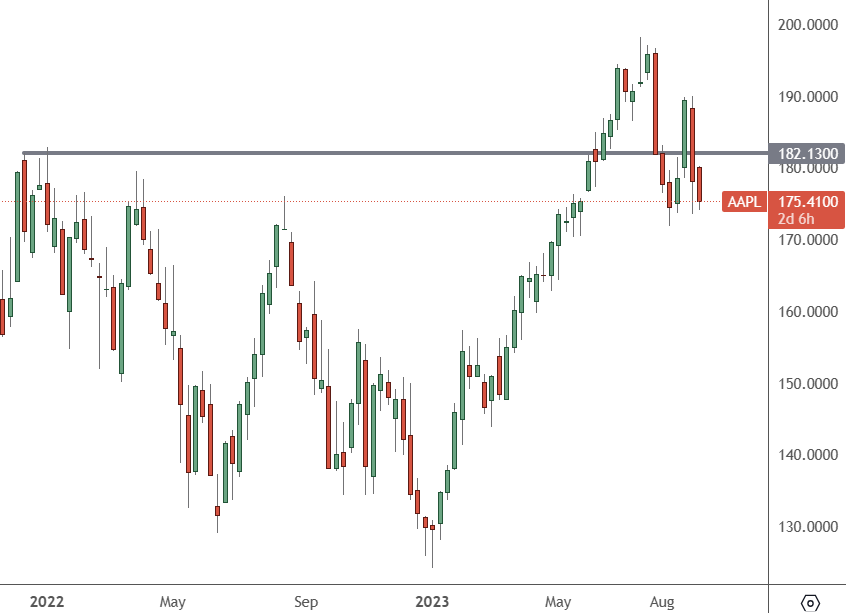

AAPL: Weekly Chart

AAPL stock lost $200 billion of its valuation recently, with the shares also closing below their previous highs early in 2022. With tech stocks under pressure, a further drop in Apple cannot be ruled out.

Chief executive Tim Cook released the new-look iPhone, Apple Watch, and AirPod models on Tuesday during the annual hardware product launch event in Silicon Valley. The event streamed live on Youtube and tried to tempt customers with improved chips and cameras in the latest iPhones, the 15 and 15 Pro. The updated devices have now switched to a USB-C charging port, aligning with European regulations coming into force next year.

On New York’s Nasdaq, where Apple is listed, it dropped 2% after the launch. The valuation drop came after news of the Chinese government’s ban on iPhones at its agencies due to cybersecurity concerns.

Victoria Scholar, at Interactive Investor, said recent developments in China have “overshadowed” the launch. “Beijing is clamping down on the use of iPhones among government officials there as US-Sino tensions intensify and technology becomes a key battleground,” she said.

Tom Forte, Senior Research Analyst at D.A. Davidson said Apple’s newly announced products may not boost their stock price into the year’s end, and investors will need to see traction on sales.

Despite the sell-off, Apple is still valued at 26X its forward earnings, which is the higher end of the last ten years. Investors should follow the Nasdaq and Apple carefully after the weekly high from 2022 was breached. Some of the tech stocks that pumped higher with the AI hype could suffer.