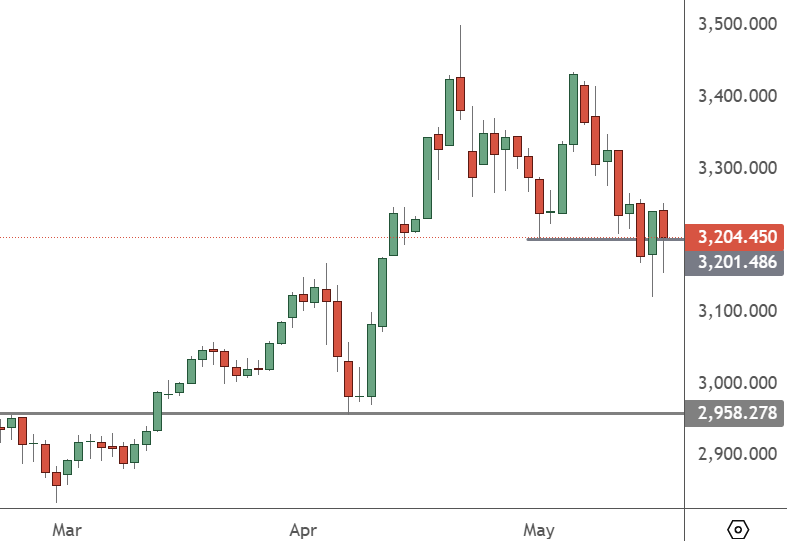

Gold’s recent correction on an end to tariffs chaos has created a pullback scenario.

The price of XAUUSD has pulled back the previous highs above $3,400 and needs to find buyers to avoid a larger pullback. There is some hope with the price action into the weekend but a failure would move back toward $3,000.

The highs in gold were created with strong inflows to ETF investments. Global exchange-traded funds backed by bullion reported their highest monthly inflows since 2022 in April, World Gold Council (WGC) showed.

The month ended with 3,561 tonnes locked up in ETFs, after a 115 tonne rise from March. Holdings reached unseen levels since the pandemic period of October 2020. The total value of April inflows was $11 billion, marking a fresh record of $379 billion.

Asia was the big driver with almost two-thirds (65%) of the worldwide total. Monthly inflows of $7.3 billion were the strongest on record, pushing AUMs in the region to $35 billion. Physical holdings rose to 320 tonnes, marking a 70-tonne monthly increase.

The 90-day pause in tariffs has supported the market but may also lead to a larger correction if there is a longer-term deal between the US and China.

The downgrade of US debt by Moody’s has added some further uncertainty to demand for the greenback but may not be enough to hold onto the uptrend.

“The ongoing trade dispute with the US, which has raised fears of weaker growth, amplified equity volatility, and intensified expectations of the local currency depreciation” also boosted gold demand, as did weaker government bond yields,” the WGC report said.

Economist Peter Schiff was critical of Bitcoin again, saying: “Bitcoin rallied with other risk assets as investor’s recession and inflation fears subsided. Gold sold off for the same reasons. Bitcoin is the opposite of gold”.

His comments came after JP Morgan analysts said BTC could outperform gold in the second half of the year.