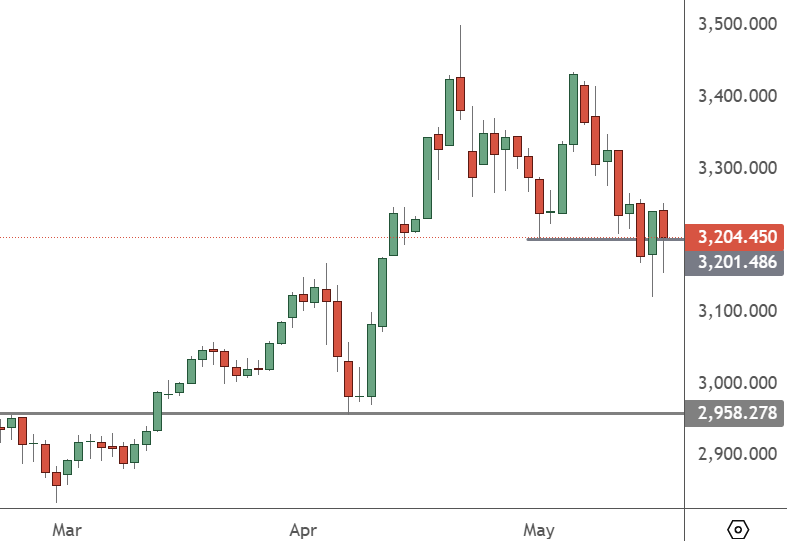

金价近期因关税混乱局面的结束而出现回调,这创造了一种回调的空间。

黄金价格已经从之前的高点3400美元上方回落,需要找到买家以避免更大的回调。最新价格走势有一些希望,但如果失败,将回落至3000美元。

黄金价格的高点是由大量资金流入ETF投资创造的。世界黄金协会(WGC)显示,4月全球黄金交易所交易基金(ETF)录得2022年以来最高月度资金流入。

2月结束时,ETF持仓3561吨黄金,较3月增加115吨。自2020年10月大流行期间以来,持有量达到了前所未有的水平。4月资金流入总额为110亿美元,创下3790亿美元的新纪录。

亚洲是最大的推动力,占全球总量的近三分之二(65%)。月度流入73亿美元是有记录以来最高的,将该地区的资产管理规模推高至350亿美元。实物黄金持有量增至320吨,每月增加70吨。

暂停征收关税90天支撑了市场,但如果中美之间达成一项更长期的协议,也可能导致更大规模的回调。

穆迪下调美国债务评级,给美元需求增加了一些不确定性,但可能不足以维持上升趋势。

世界黄金协会的报告称:“与美国持续的贸易争端引发了对经济增长放缓的担忧,放大了股市波动,加剧了对本币贬值的预期,这也提振了黄金需求,政府债券收益率走弱也是如此。”

经济学家彼得·希夫再次批评了比特币,他说:“随着投资者对经济衰退和通胀的担忧消退,比特币与其他风险资产一起上涨。黄金也因同样的原因遭到抛售。比特币是黄金的对立面。”

在他发表上述言论之前,摩根大通分析师表示,比特币在今年下半年的表现可能会超过黄金。