What is PAMM and How Does it Work?

Open PAMM Account in 3 Steps

Open PAMM Account with ATFX

Sign Up

Refer Clients

Earn More

What is a PAMM account?

The forex market is the biggest and most liquid financial market globally. It provides great opportunities for investors and traders. A financial tool that has gained popularity in this market is the Percentage Allocation Management Module or PAMM. PAMM is a unique investment method that offers investors great profitability and convenience. However, it is crucial to understand how the account works before investing.

A PAMM account is an investment tool developed by brokers for managing funds. In essence, it allows one trader, the PAMM manager, to handle their own capital and that of other investors, all from a single account.

How Does PAMM Account Work?

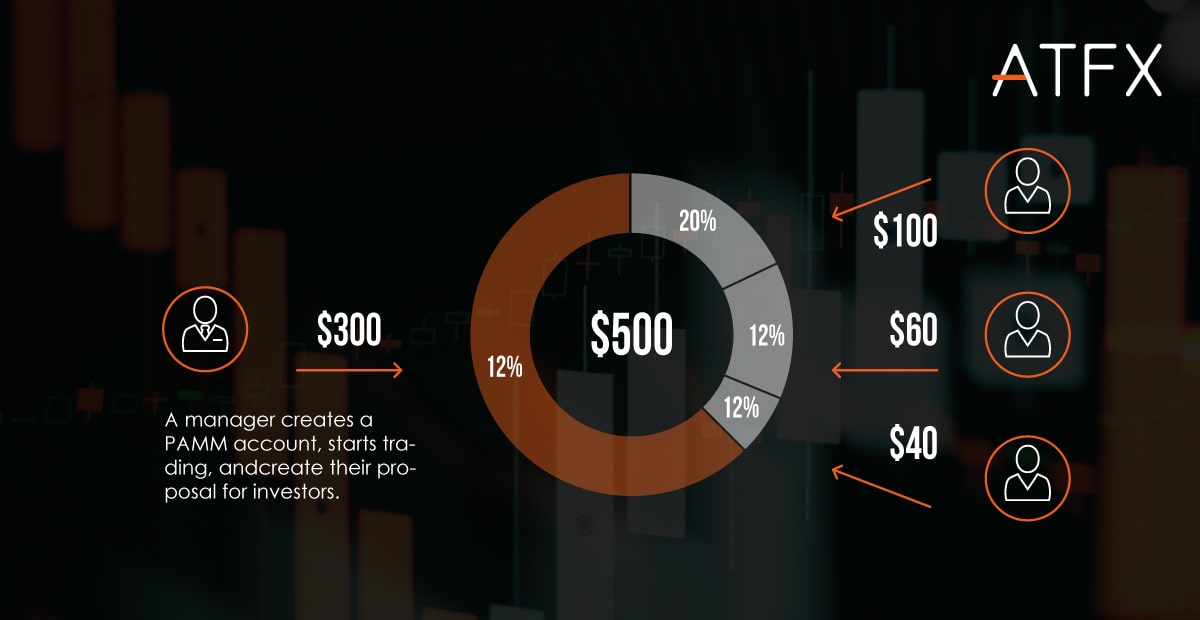

The workings of a PAMM account are straightforward. The PAMM manager opens an account and allocates a certain amount of their own capital – which is known as the “Manager’s Capital.” The manager shares profits with investors based on the respective amount they deposited when profitable trades are made.

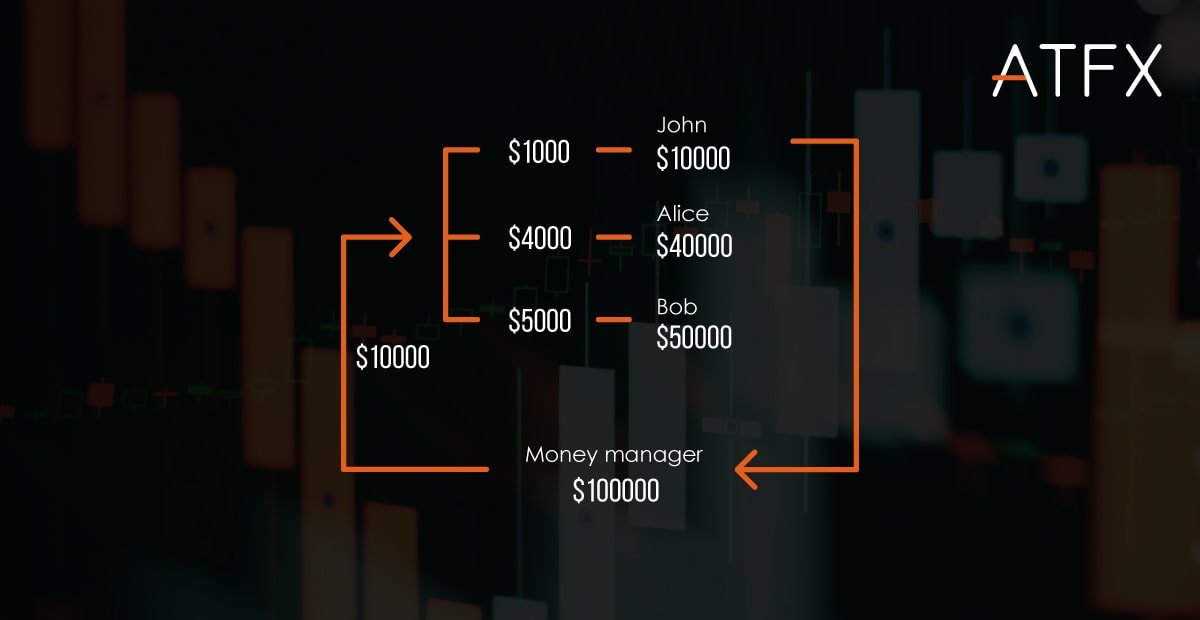

Imagine a scenario where there is a PAMM manager, John, with $10,000 of his own money. He opens a PAMM account, and two investors, Alice and Bob, decide to join him, investing $40,000 and $50,000 respectively. Now, the total capital in the PAMM account is $100,000.

The profit or loss from the trades John makes will be shared between John, Alice, and Bob proportionally. If John, the money manager, makes a profit of $10,000, he gets $1,000, Alice gets $4,000, and Bob gets $5,000, based on the corresponding amount they contributed to the total account balance.

The same holds true if the money manager is only trading for one client with an account balance of $50,000 and makes a profit of $5,000 (10%), the client will receive the entire amount. The same rules apply to any number of clients and each receives the loss or profit based on their account size at the beginning.

Clients retain ultimate control of their accounts and can take back the power of attorney for trading assigned to the money manager at any time. Clients can also set an automated stop loss order that prevents the money manger from trading once they hit a certain loss percentage.

PAMM clients can also decide to activate their accounts and give approval to join the money manager. The manager can choose whether to hold trades overnight or close then at the end of the day based on the clients preferences.

The PAMM manager is an experienced trader who trades for investors, taking a previously agreed percentage of their profits. Investors do not need to conduct trades and can rely on the manager’s expertise.

Benefits and Risks of PAMM

It’s important to understand that while PAMM accounts offer several advantages, they are not without risks.

| Benefits of PAMM | Risks of PAMM |

|---|---|

| 1. Accessibility: Allows investors to participate in Forex trading without needing detailed knowledge or experience | 1. Dependence on PAMM Manager: The success of the investment is heavily dependent on the manager’s skills and trading decisions |

| 2. Profitability: Potential for high returns if the PAMM manager is successful | 2. Potential for Loss: Risk of losing a part or all of the investment if the manager makes unsuccessful trades |

| 3. Diversification: Helps diversify investment portfolios | 3. Lack of Control: Investors have limited control over the investment strategies |

| 4. Time Efficiency: Investors don’t need to spend time trading themselves | 4. Manager Fees: Profitable trades are subject to manager fees, which can reduce the net return |

| 5. Flexibility: Investors can choose from various PAMM managers based on their risk tolerance and expected returns | 5. Broker Risks: Risks related to the broker’s credibility and reliability |

Consider the example of Linda, an inexperienced investor who opts to invest in a PAMM account managed by a seasoned forex trader instead of trying to navigate the volatile forex market on her own. After a year, she finds her initial investment has yielded a significant return, demonstrating the potential benefit of PAMM accounts.

However, PAMM accounts are not without risks. The main risk lies in the potential loss of part or all of the investment amount if the PAMM manager makes unsuccessful trades. For instance, David invested in a PAMM account, but the manager made several poor trades, leading to a loss of 20% of the initial investment. This highlights the importance of choosing the right PAMM manager.

Comparing PAMM with Other Investment Methods

PAMM are not the only option for investors looking to make profits from forex trading. Individual trading and other social trading platforms like MAM (Multi-Account Manager) and LAMM (Lot Allocation Management Module) are alternatives.

With individual trading, investors make their own trades. This option provides the most control but requires a deep understanding of the forex market. For instance, Peter, an experienced trader, prefers individual trading because he enjoys analyzing market trends and making his own investment decisions. Over a year, he achieves a 15% return on his investment capital.

On the other hand, MAM and LAMM accounts, like PAMM accounts, allow investors to benefit from the skills of experienced traders. However, they differ in how trades are allocated. MAM accounts allocate trades based on the investor’s account balance, while LAMM accounts allocate trades in pre-determined lot sizes.

Choosing a PAMM Account

Selecting the right PAMM account is a crucial step in your investment journey. When selecting a PAMM manager, it’s important to take into account their trading history, risk level, fee structure, communication skills, and the degree of control you desire over your investment. Some PAMM accounts have a ‘stop-loss’ limit which helps to safeguard your capital.

For instance, Emma is looking to invest in a PAMM account. She researches different PAMM managers, carefully considering their trading performance, strategies, and fees. She finally chooses a manager who communicates well, has a proven track record, and whose risk level matches her own risk tolerance.

Open a PAMM Account with ATFX

Sign Up

Refer Clients

Earn More

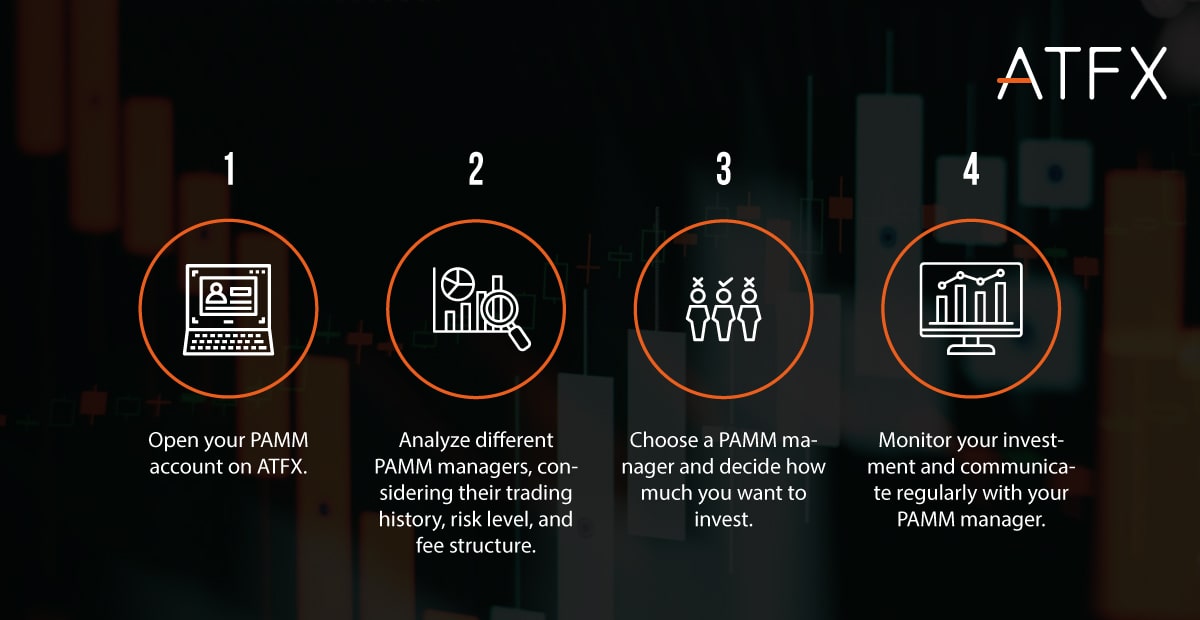

Steps to Start Investing in a PAMM Account

To start investing in a PAMM account, follow these steps:

- Open your PAMM account on ATFX.

- Analyze different PAMM managers, considering their trading history, risk level, and fee structure.

- Choose a PAMM manager and decide how much you want to invest.

- Monitor your investment and communicate regularly with your PAMM manager.

Conclusion

Investing in PAMM accounts can provide an attractive opportunity for individuals looking to profit from the forex market without needing to be trading experts. It’s important to understand the workings of these accounts and their associated risks before committing to an investment. Always research thoroughly, ask relevant questions, and consider consulting a financial advisor to make well-informed decisions.