→How to Invest in the Stock Market?

Portfolio Diversification

Instead of trading most of your capital in a few stocks or those stocks that are too similar, you should diversify your portfolio. The main advantage of diversifying your stock portfolio is that your overall losses harm the rest of your portfolio if there is a sudden drop in one sector. For example, banking and construction stocks tend to perform well whenever the average index performs well. On the other hand, volatile financial markets and an underperforming economy usually have some stable sectors, like pharmaceuticals performing well.

The thumb rule of investing in stock markets is to avoid committing 100% of your capital at once. Consider your bankroll available for investing and commit small amounts periodically. This will protect you from losing it all during a prolonged market decline. Secondly, you can buy stocks at lower prices than you would have done earlier.

One good way around it if you are not sure about the exact stocks to pick for diversification, you could start by choosing stock sectors or industries which balance out. These are referred to as cyclical and non-cyclical sectors. Cyclical sectors are those that perform very well when the economy is booming, and non-cyclical sectors are those that stay relatively stable even in a weak economy. Some non-cyclical sectors include healthcare and utilities, which remain in demand even when the economy falters. The most recent example is the performance of the health sector during the COVID-19 pandemic, during which bio-research stocks were in high demand.

Establish realistic profit expectations

The allure of making it big within a short period has always drawn investors to invest in stock markets aimlessly. Making money trading equities is not that easy. Success in the stock markets needs investors to have patience, good strategies, and at least some knowledge of how the markets work. Advanced research and basic market monitoring tools for dummies are a plus before making your first deposit to buy a stock. Index volatility has also confused people and added more investment dilemmas in recent years. Make your buy or sell decisions and profit targets based on informed optimism.

In other words, if you expect a stock to rise by 50% in some coming years, there have to be some projections, pointers, and tidbits of the company news that suggest the possibility. It’s okay to expect the best every time you invest but never have unrealistic assumptions surrounding a stock. Gauge a stock based on projected future performance and not purely on past trends. Some stocks may have generated more than 50% growth in the recent bull run, but changing technological and lifestyle trends may affect the company’s performance. Stocks rarely give the same level of monthly or yearly return consistently. Always gauge economic and industrial conditions and adjust your risk outlook.

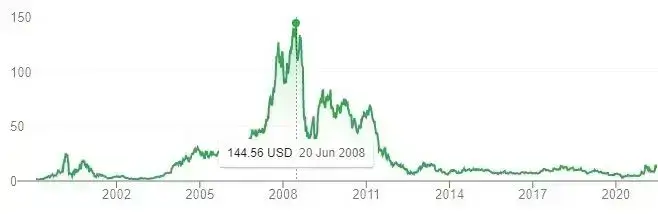

A good example of this case is the company BlackBerry (NYSE: BB). Mostly known for its innovative and stylish smartphones around 2008, its stock grew from around $13 per share to highs of $144 in mid-2008. However, according to what some may suggest were rigid policies and failure to adapt to newer cellphone OS trends, the phones drew less appeal from the rapidly-expanding segment of younger consumers. Investors who bought the stock while at its peak and stayed ‘hopeful’ when the competition kicked in probably lost a lot in the years after.

Blackberry (NYSE: BB) historical performance

Blackberry (NYSE: BB) historical performanceProtection from trading fees

Trading in stock also involves some trading fees. You should keep these trading fees low as they only take up a small percentage of your profits. For example, when you have only $100 dollars to trade and buy a stock worth $10, it would need to rise by $10 to recoup the equivalent profit of $5. Supposing someone opted to sell the stock and pay another $5 as trading fees, the whole ’round trip’ would be net-zero.

Always note that each time you place a new trade, your account equity immediately goes down by a certain percentage that needs to be filled up before you go into profit if the trend works in your favor. Choose brokers with affordable trading fees and invest enough to negate the minimum trading fee.

For example, if you invest $2000 in one trade and the fee per trade is $5, you would have incurred less in trading fees compared to the person who used $100 for a single trade. Always confirm with your broker the fees you charge for handling your trades. On the bright side, online brokers have lately provided account types with competitive fees, with some offering zero charges if certain conditions are met. Protecting yourself from high trading fees ensures that you are working to grow your wealth instead of enriching your broker.

Master your emotions

Trade with your mind, not your moodsSome professional investors keep performing below the market average for one reason: they allow emotions to dictate their trading. Some emotions that interfere during bull markets include greed, trying to outsmart other traders, and outright overconfidence. When it is a bear market season, emotional investing comes packaged as panic-selling or choosing to purchase stocks irrationally at a price level still showing signs of falling further. Both of these emotional investing types still wipe out your overall returns. Emotional trading makes most investors step out of their initial trading strategies.

A careful analysis of the S&P 500 index during 2018 reveals that, on average, most investors underperformed in the market. The average investor lagged behind the index average by 100 basis points in some months. Sadly, they lagged behind the index even when the market showed a resurgence. The best month for the S&P was August, but the average stock investor return was 1.80% versus the index’s +3.36% overall return. October, the worst month, saw the average investors return at -7.97% while the overall market return was -6.84%. That means that investors lost more than the market when it was doing poorly and still gained less than when it regained its strong performance.

From a bird’s eye view, even with the cash flow remaining constant, the average investor tried to reduce exposure during the bad months but failed to capitalise enough by reinvesting when the market was trending higher. The only explanation for that is a lot of panic selling happened when the index was performing poorly, and most people stayed out of the market when it was the right time to buy shares on the cheap.

One of the best tips you can get in 2021 is not to invest with emotions as the driving force. The same applies whether you invest by yourself or let a fund manager do it. Emotion and sentimental attachment to certain brands make people have too much optimism about a poorly performing company. By mastering their emotions, even shrewd investors can cash in early during good times and instead throw good money after bad money.

Staying calm when the market is going through a rough patch is not easy. Watching an index tumble overnight can be a nerve-racking experience, but smart investors usually have a game plan that lets them know what to do in such situations. Beginners should approach the stock market knowing what to do about the stocks that are falling and what to do about the stocks that are rallying. Have a demo account or a watch list where you can trade losing stocks and winning stocks separately without having to risk real money. Above all, regularly adjusting your portfolio by moving your money between different sectors is the best way to grow faster than an investor who enters the market when things are good and withdraws when they sense trouble.

Due diligence in choosing the right broker and the right stock

Always do your due diligence about a stock and its company before making any decisions. By law, listed companies must periodically submit paperwork to the authorities and the general public to make investment decisions. These documents let stakeholders know crucial metrics like revenues, debts, expenses, and profits. They often make earnings projections, which are good informers that help current and potential investors know whether to invest more in the stock or if it’s time to sell off.

Investors look for common metrics when evaluating a stock’s earnings potential, including the price-to-earnings ratio, its earnings per share, and in some cases, the return on equity. They are preferred because they give a relatable figure that can compare stocks even if they have different total net profit figures and operate in different industries. Technical analysis will work if you want to take it further and rate a stock trend with a few glances. In a simple sense, technical analysis is just looking at a stock and analysing its common patterns, and noticing how the trend behaves when some pattern appears.

Technical analysts note that when a stock closes above or below a long-term moving average, it is likely to continue gaining momentum in the direction it closed at. These clues are mostly pure price action and only sometimes due to some new developments in the stock company. Technical analysis offers a reliable way to look at a chart and tell whether the stock is trading at strength or weakness and gives you clues to whether your profit targets are realistic, going by history.

In regards to stockbrokers, gone are the days when the financial industry solely relied on having to make phone calls and ordering specific trades. Lately, brokers have worked more efficiently using financial software platforms. Digital platforms are the most assiduous stockbrokers today and have simplified and reduced the costs incurred on placing trades in the stock market today. It would be best to deal with a broker that does not charge high transaction fees but offers low spreads and good customer service. Choose a licensed broker with good ratings that will not endanger your finances, especially when handling cash withdrawals.

Due diligence on your broker will reveal crucial aspects that affect your trading career. Some brokers may not be suitable for your investing strategies and the frequency with which you trade. The capital at your disposal also determines your compatibility with the online broker. For example, investors with little money to start trading need to ensure the chosen broker’s minimum deposit requirements align with their capital. Day traders would also want brokers with low transaction fees because their strategy relies on making smaller profit margins over many trades.

Summary

Beginner stock traders still have a good chance of succeeding in the market if they play their cards well. They can master the right way to rate stocks and invest in the stock market without letting emotions interfere. Learn how to engage with all stakeholders and get professional opinions while comparing them with your point of view. The secret to getting into the 10% that makes consistent profits in the stock exchange is understanding the crowd sentiment but choosing not to follow the crowd blindly. Reasonable goals, protecting your profits, and the constant desire to stick to your strategy will help beginner stock traders avoid the pitfalls that most failing stock traders encounter.

You can put your goals into play immediately by opening an account and applying these tips to become a successful stock trader. Opening an account at ATFX is easy, and you can start trading within one day. ATFX offers good liquidity, very competitive spreads, and an award-winning team of financial and technical professionals who will guide you when you need help. You can take advantage of the free training tools like demo accounts and one-to-one coaching programs when you sign up. Take action today by joining ATFX to develop a trading plan that suits your financial goals and make money in the stock markets.

Blackberry (NYSE: BB) historical performance

Blackberry (NYSE: BB) historical performance