What is a candlestick chart ?

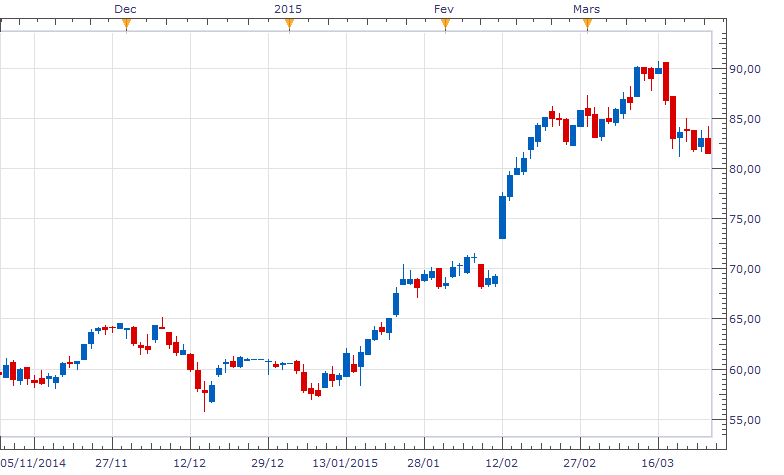

Candlestick chart is a way to show price data in the form of candlestick-looking units, each unit is put together and becomes the so-called “candlestick chart”.

This graphical representation is undoubtedly the most used by day-to-day traders as it provides much useful information, such as opening price, high price, low price, and closing price.

Candlestick is also called “Japanese Candlestick” as it originated in Japan in the 16th century.

The chart may look complicated at first, but it’s easy to understand, and we’ll show you how to read them.

4 things to look at in the candlestick chat :

Periods

A candlestick corresponds to a period (in units of time). This period can be modified on the trading platforms according to your investment plan or strategies. Commonly, the time units used are m1 (one minute per candlestick), m5, m15, H1 (one hour per candlestick), H4, and D1 (one day per candlestick).

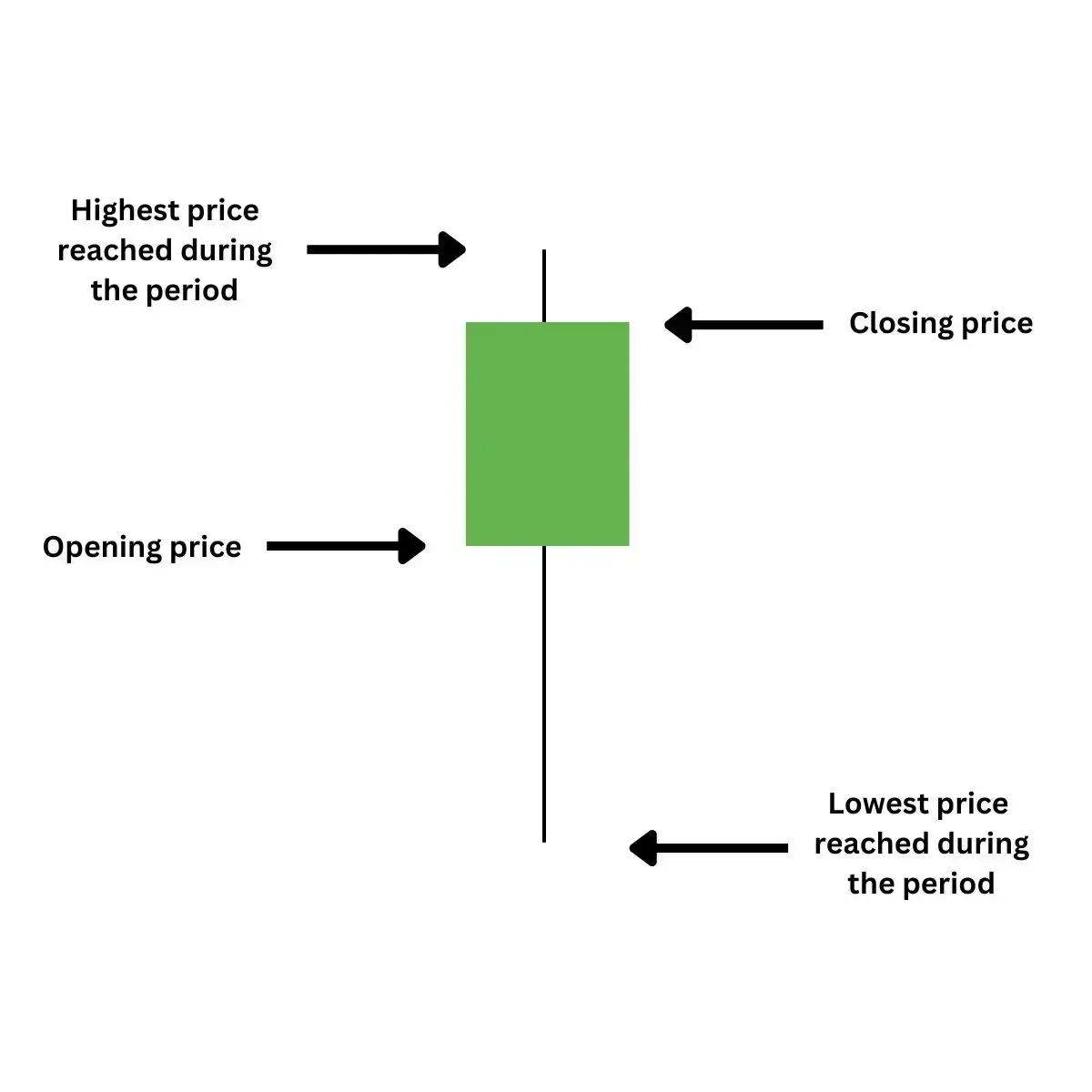

The bullish candlestick (or rising candlestick)

Often green or blue, the rising candlestick indicates that the price level at the end of the period is higher than at the beginning.

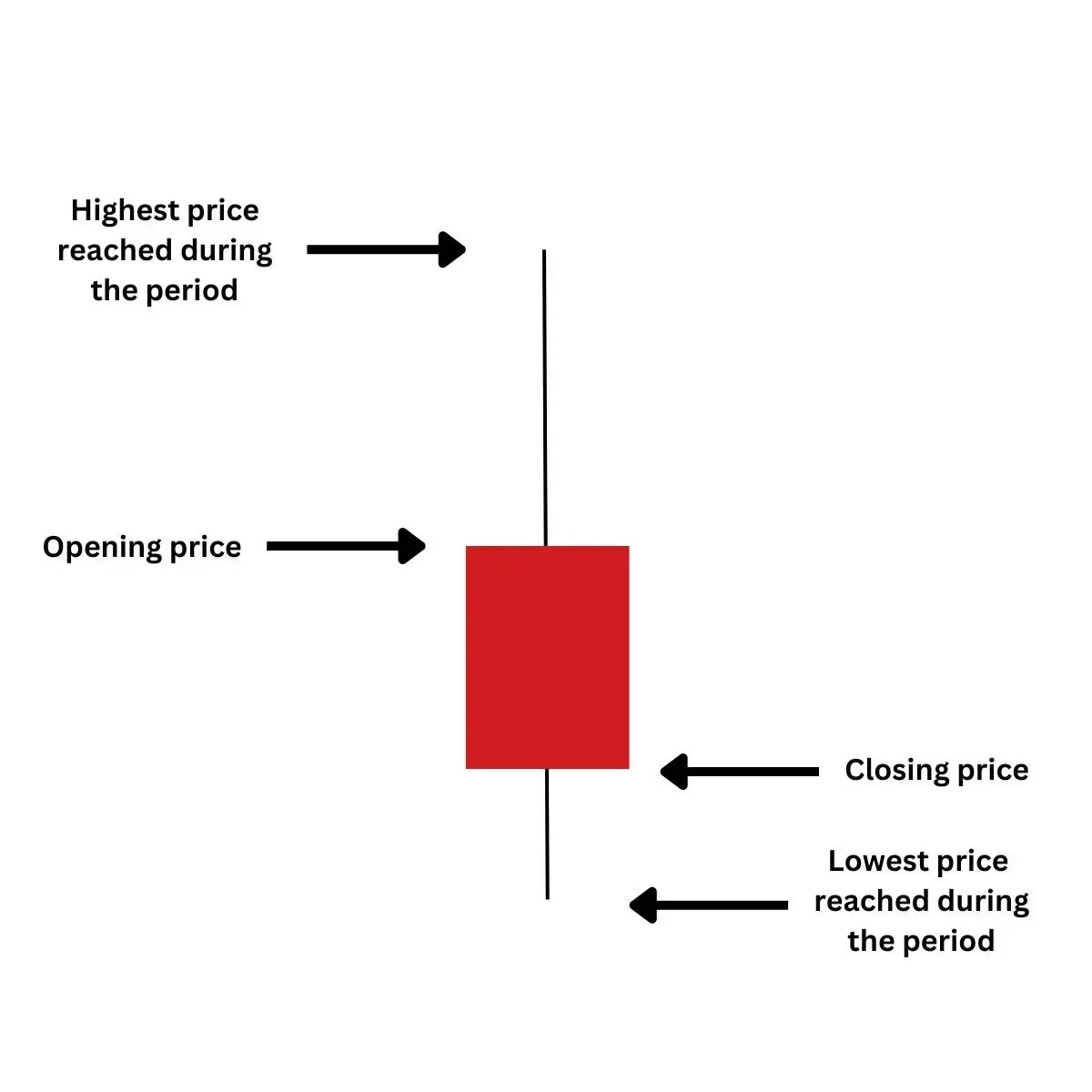

The bearish candlestick (or falling candlestick)

Often in red, the falling candlestick indicates that the price level at the end of the period is lower than at the beginning.

Formation of a candlestick

The candlestick forms and evolves during its defined period. Below you will notice that the candlestick can go down or up in the same time frame. It is only at the end of the period that the candlestick will take its final form.

Learn better with a demo account

If you wish to improve your knowledge of candlestick charts before investing your hard-earned money, we suggest you open a demo account. ATFX offers all the major financial products on a solid trading platform to practice different strategies while still learning from a guide or the free training materials ATFX provides. So, get your demo trading account for free now !

You may also be interested in learning how forex traders use candlestick charts to analyse market trends.