On Tuesday, the US dollar paused at 104.51, soft against a basket of major currencies but did not drift far from a two-month peak after a deal over the US debt ceiling lifted risk sentiment. However, the agreement could face a rocky path through the Congress. The US dollar, as investors adopt a “wait and see” approach ahead of a series of key data releases this week.

Investors are awaiting the release of several important economic indicators, including the US non-farm payrolls report due on Friday. The report is expected to provide further insight into the state of the US labour market. In addition, it could significantly impact the Federal Reserve’s monetary policy decisions on Jun 14.

This week’s key data releases include the US ISM manufacturing index, due on Wednesday, and the ADP employment report, due on Thursday. The ISM manufacturing index is a widely watched indicator of economic activity in the manufacturing sector. At the same time, the ADP employment report provides a preview of the non-farm payrolls report.

Investors are also closely monitoring developments related to the US-China trade war, a significant source of uncertainty for financial markets in recent months. Any positive effects on the trade front could boost the US dollar, while negative news could lead to further weakness.

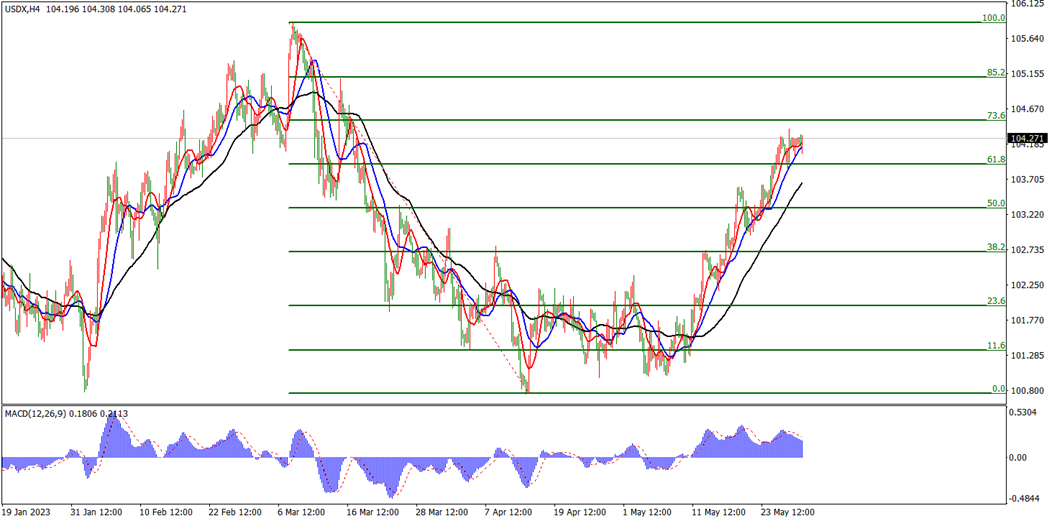

US Dollar Index Forecast

In the meantime, the US dollar will likely remain under pressure as investors adopt a cautious stance ahead of the key data releases. Analysts say that the recent softness in the US dollar could also be attributed to the Federal Reserve’s dovish stance, as policymakers have indicated that they are willing to be patient in raising interest rates.

Overall, the outlook for the US dollar remains uncertain as the market awaits further guidance from key economic indicators and developments on the trade front. As a result, investors will likely remain cautious in the short term, which could lead to further weakness in the greenback, according to the MACD shown an overbought in the 4-hour chart (Graph above). However, if the data releases come in better than expected or if there are positive developments on the trade front, the US dollar could rebound quickly. Therefore, investors should always remain vigilant and closely monitor market developments to make informed trading decisions.