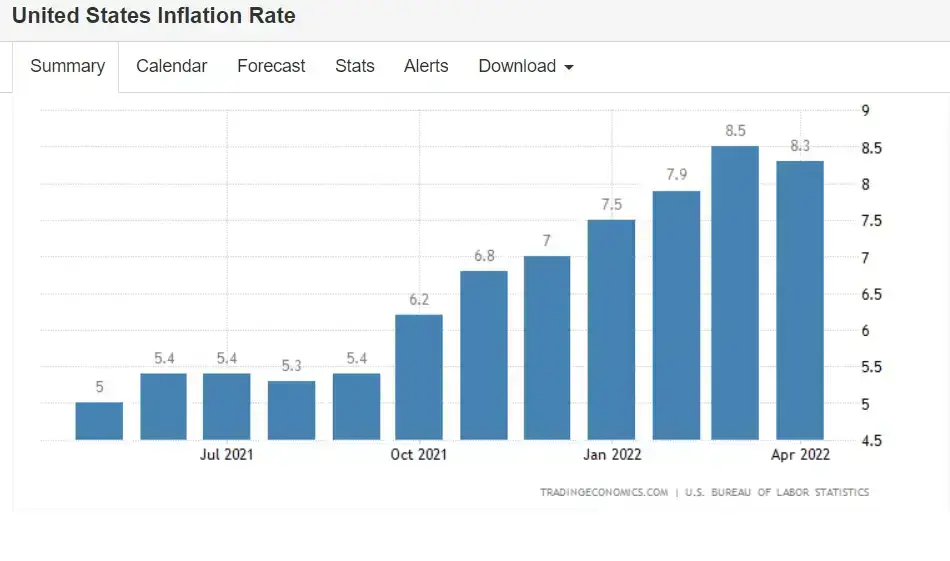

The market is watching the US unseasonal CPI for May, which is set to be released today. The print was recorded at 8.3% in April, with a current market estimate of 8.20%. Before the Fed’s June interest rate decision, the market expects a 50 basis point hike to be the most likely, at 94.8%. Hence we cannot ignore the importance of tonight’s data on the future rate hikes and the dollar’s direction.

Suppose the unseasonal-adjusted CPI remains at 8% or more, in line with market expectations. This means that inflation levels in the United States are yet to be effectively controlled. In that case, the market expectations of the Fed to take more aggressive rate hikes will rise further, which will help push the dollar higher. Conversely, suppose the CPI data is lower than market expectations. In that case, it may increase the market’s expectations of the Fed, slowing the pace of interest rate hikes or even stopping the pace of interest rate hikes, putting pressure on the US dollar.

Current market expectations of interest rate hikes are showing signs of heating up. In contrast, market expectations reversed that the Fed will likely stop raising interest rates in September. Mainly because many Fed officials have recently said they still want to raise interest rates to a neutral level quickly. Among them, Fed Governor Waller said he would support the continuation of the rate hike policy by 50 basis points in the next few meetings.

Fed Vice Chairman Lael Brainard said market expectations of a 50 basis points rate hike in June and July seem reasonable. Still, it is difficult to predict precisely when US inflation will fall; hence, it is difficult to find a reason to pause rate hikes in September.

US Treasury Secretary Janet Yellen said US inflation is unacceptable and that an appropriate budgetary stance must curb inflation without harming the economy.

The Fed has repeatedly indicated to markets that interest rates will rise by 50 basis points at policy meetings in June and July. In addition, several officials’ consistent “hawkish” views further boosted market expectations for interest rate hikes.

In addition, non-farm payrolls from the United States added 390,000 people in May, beasting analysts’ estimates of 320,000 new jobs. Substantial market employment also increased the possibility of accelerating wages, thus, increasing labour costs and exacerbating inflationary pressures. The market will also pay attention to whether inflation has peaked. The data released today will also play a key role in measuring the inflation trends. Of course, we cannot rule out that inflation will rise again after a decline.

At present, the US inflation is difficult to cool down in a short period. Upon entering the summer energy demand season, energy prices are expected to rise much further. In addition, the situation in Russia and Ukraine has impacted global energy and food prices but continues pushing food prices higher in the United States. Despite the gradual recovery of demand for services and commodities, global supply chains still need time to recover. These factors have added to the market’s forecast for the Fed’s June rate hike.

The expectation of interest rate hikes is pretty favourable for the future direction of the US dollar. The US dollar index was in an upward trend in early June after falling at the end of May and is expected to retest 103. Tonight’s data is expected to guide the US dollar’s direction further. The market’s concerns about high inflation levels are unlikely to change until the data supports a different view. Still, the future trend of the US dollar will have to wait until June 15, when the Fed finally announces the outcome of its rate-setting meeting.