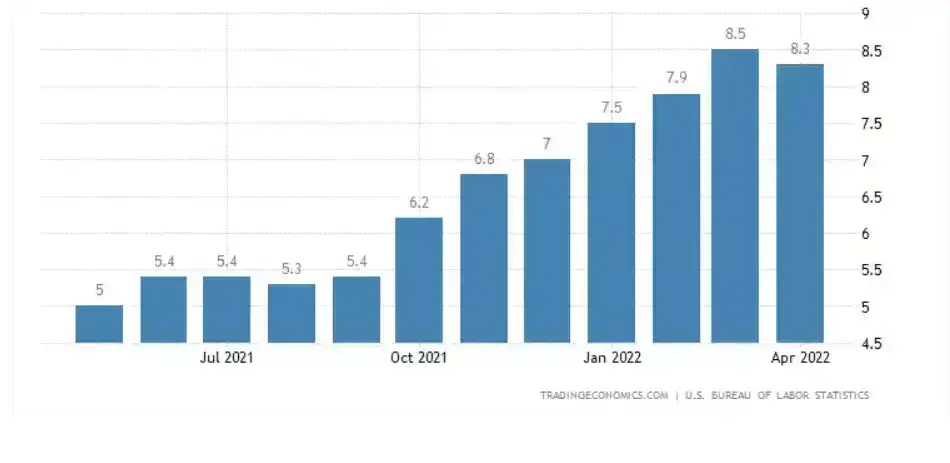

今晚,市場關注的美國5月未季調CPI年率即將出爐,該數據4月份錄得8.3%,當前市場預計值為8.20%。 在美聯儲6月利率決議前,市場預計加息50個基點的概率最大,達到了為94.8%,因此今晚的數據表現對於未來加息和美元的走向顯得非常關鍵。

如果未季調的CPI年率如市場預期繼續維持在8%或以上,這意味著美國的通脹水準仍然未得到有效控制,市場可能預計美聯儲會採取更積極加息措施的可能性或將進一步上升,這將有利於推升美元。 反之,如果CPI數據低於市場預期,有可能會增加市場對於美聯儲放緩加息步伐或者停止加息步伐的預測,從而會令美元承壓。

近期在市場中加息的預期出現升溫跡象,而此前有市場人士稱美聯儲將可能在9月停止加息的消息得到反轉,主要是多位官員近期表示仍希望迅速加息至中性利率水準。 其中,美聯儲理事沃勒表示,將支援在未來幾次會議上繼續把政策利率上調50個基點。

美聯儲副主席布雷納德表示,市場對6月和7月各加息50個基點的預期似乎是合理的,很難準確預測通脹何時會下降,並且現在也很難找到9月暫停加息的理由。

美國財長耶倫表示,美國通脹正處於不可接受的水準,需要採取適當的預算立場,在不損害經濟的情況下抑制通脹。

美聯儲主席鮑威爾在內的多位美聯儲官員早前也已經多次向市場傳遞將在6月和7月政策會議上繼續分別加息50個基點的信號。 多位官員較為一致的「鷹派」觀點進一步助推了市場對於加息的預期。

另外,從美國5月非農就業新增39萬人,預期為32萬人,超出市場預期,強勁的市場就業也推升了工資加速上行的可能,因此會增加工作力成本,加劇通脹的壓力。 市場也會進一步關注通脹是否已經到頂,此次釋放出的數據也是衡量通脹走勢的關鍵,當然也不能排除通脹在有所下降之後重新出現上升。

目前來看美國通脹在短時間難以降溫,即將進入夏季能源需求旺季,能源價格有望出現進一步上升,俄烏局勢正對全球能源和食品價格產生影響,也在持續推升美國的食品價格,加上對服務業和商品需求逐漸恢復,供應鏈的修復仍然需要時間。 這些因素都增加了市場對於美聯儲6月加息的預測。

加息預期的升溫更加利好美元未來走勢的預期,美元指數在5月底走低之後,6月初一路呈現上升趨勢,有望上試 103。 今晚的數據有望對美元走向提供進一步的指引,從目前的消息面上看是利好美元前景,由於市場對於高通脹的擔憂仍然短時間難以消除,但是美元未來的走勢還需要靜待6月15日美聯儲最終宣佈會議結果才會更加明朗。