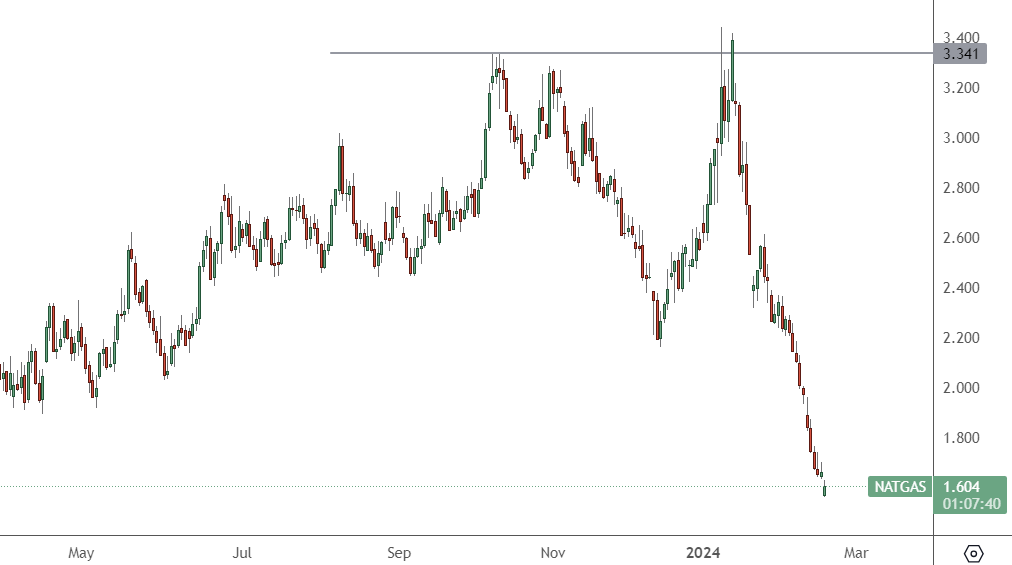

The price of natural gas has sunk from 3.341 in January to 1.60, despite the tensions in the Middle East.

GAS – Daily Chart

The gas price has slumped through the 2023 lows near 1.80, and there will likely be volatility ahead as the price, in part, looks to have been created by forced selling.

Natural gas was unable to increase after Iran accused Israel of attacking one of its vital gas pipelines last week. The New York Times reported that Iran had proof of Israeli involvement in the attack. At the same time, Israel continues its pressure on Gaza and Hamas.

Bearish positions for a further decline in prices continue to grow despite the lowest price level since 1990. Hedge funds and money managers sold 391 billion cubic feet on the two major futures and options contracts linked to the US Henry Hub benchmark price last week.

Fund managers have been selling gas in the four most recent weeks, reducing their combined long positions by 1,687 cubic feet since the middle of January, data from the US CFTC showed.

Money managers have tried to predict a breakout in gas since last year, and the latest resistance above $3 led to a sharp unwind of those speculative positions. External factors such as mild temperatures have helped to keep a lid on prices, while gas inventories are well above their seasonal average throughout North America and Europe, with the surplus in both regions continuing to build.

The price of natural gas will be driven lower by some forced selling by hedge funds. That could provide traders with some sharp bounces and rallies to sell.