Ratings agency Moody’s has warned US lawmakers that a shutdown could further hurt the country’s debt rating.

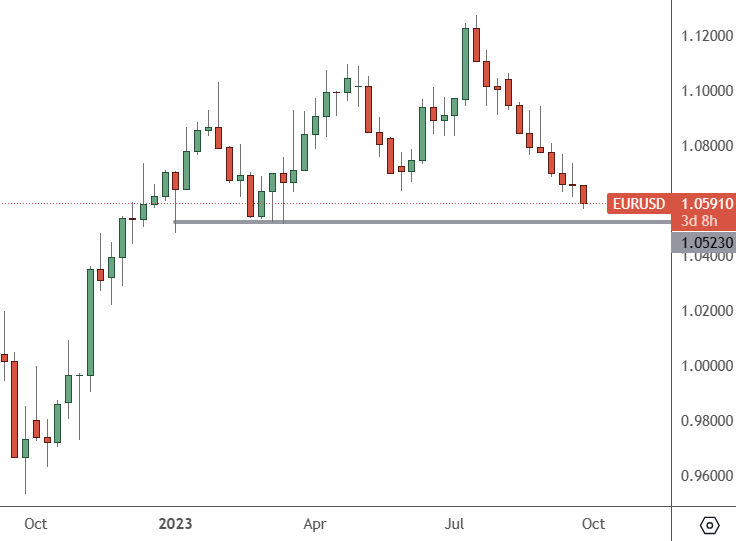

EURUSD: Weekly Chart

EURUSD on the weekly chart has support at the 1.0530 level. It is important to hold that, or we could see a further breakdown in the euro and further dollar strength.

A US government shutdown would harm the country’s credit, rating agency Moody’s said on Monday, which comes one month after Fitch downgraded the country’s debt by one level after the recent debt ceiling crisis.

Government services would be disrupted, with hundreds of thousands of federal workers furloughed without pay if Congress fails to agree on funding for the fiscal year starting October 1.

A shutdown would be further proof that political uncertainty is harming the reputation of the US. This also comes at a time when monetary policy has been tightened to fight inflation. That is harming US government debt affordability due to higher interest costs, Moody’s analyst William Foster told Reuters.

“If there is not an effective fiscal policy response to try to offset those pressures, then the likelihood of that having an increasingly negative impact on the credit profile will be there,” said Foster. “And that could lead to a negative outlook, potentially a downgrade at some point, if those pressures aren’t addressed.”

Moody’s rates the US government debt at “Aaa” with a stable outlook, the highest creditworthiness available. It is the last major agency with a perfect rating in the US after Fitch downgraded the government in August to AA+, the same rating given by S&P Global in 2011.

“Fiscal policy making is less robust in the US than in many AAA-rated peers, and another shutdown would be further evidence of this weakness,” Moody’s said.

Lael Brainard, a top economic advisor in the US, said Moody’s comment highlighted the risks caused by political fighting.

“Today’s statement from Moody’s underscores that a Republican shutdown would be reckless, create completely unnecessary risks for our economy, and lead to disruptions for communities and families across the country,” Brainard said.

The US dollar has been unfazed as US yields have risen over the past week to 2007 highs. Some of the gains in the greenback may ironically be related to safe haven flows for the potential financial fallout that a US shutdown could pose.