Walt Disney Company will release its latest earnings report after Tuesday’s bell next week.

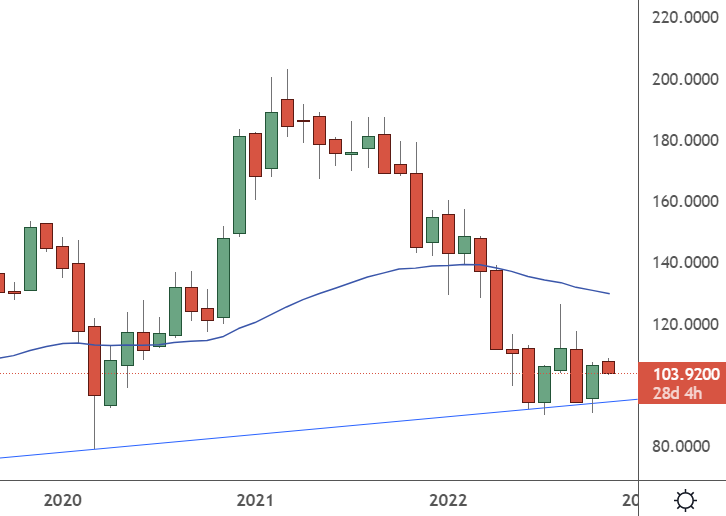

We will look at the latest price action in this article and discuss the following path for the stock.

DIS – Monthly Chart

On the monthly chart, Disney looks to have found a strong support level at the $100 mark and could push higher. DIS stock is down by 30% this year, but traders can look for an opportunity here. The key will be finding a short-term rally to play a longer-term move.

The past few years were painful for Disney investors as the pandemic led to the shutdown of theme parks and resort segments. The launch of the Disney+ streaming service proved to be the thing that saved the business.

As revenue stalled, Disney spent billions of dollars on its streaming business to keep pace with Netflix and other movie platforms. That led to a drop in revenues of 6% in 2020. Earnings per share (EPS) was hit worse with a 65% drop. Those headwinds eventually disappeared, but revenue was only 3% higher in 2021.

In the latest earnings release, the company is expected to post quarterly earnings of $0.57 per share, which would be a year-over-year change of +54.1%. Revenues are expected to be $21.11 billion, up 13.9% on the year.

On the theme parks side of the business, China’s zero covid policy affects Disney. Disney’s (DIS) Shanghai resort suspended operations to comply with virus prevention measures. Many visitors have been locked inside the park until they show a negative test.

A future revenue stream for Disney could be the metaverse, and CEO Bob Chapek confirmed that this would work with Disney+. Users could experience theme park rides in virtual reality to support “the 90 percent of people that will never ever be able to get to a Disney park”.

Disney could see a positive continuation of its recent earnings trends, and the stock has the potential to continue higher from this base.