The Hong Kong share market is pointing lower and may get dragged lower by the US impact on global stocks.

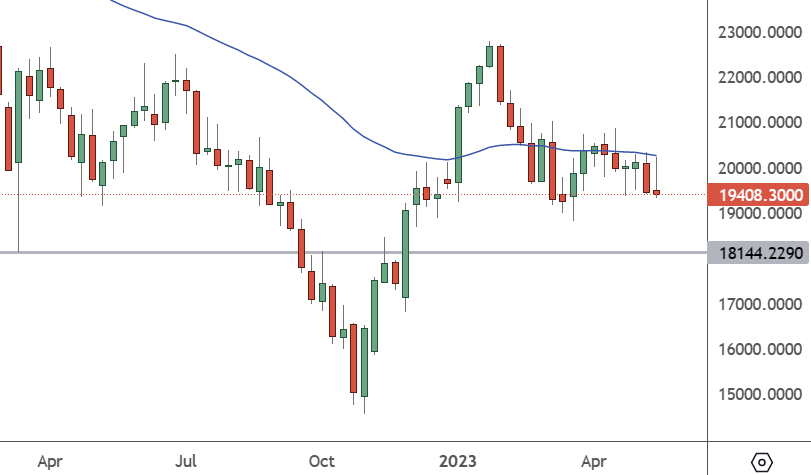

HK50 – Weekly Chart

The HK50 index trades at 19,408, with support coming in lower at 18,144, a support level back in March 2022.

Stocks fell in Hong Kong last week after Alibaba posted a fourth-quarter sales miss adding to fears of a broader slowdown in China’s post-Covid recovery. The e-commerce giant reported a 3% drop in domestic sales. In contrast, the cloud segment reported its first-ever year-on-year revenue dip. Alibaba said it would seek an IPO spin-off for its cloud business and consider separate listings for its logistics and grocery businesses.

China’s diplomatic relationships are also back on the agenda after G7 nations sent a warning to the country.

British Prime Minister Rishi Sunak said China posed “the greatest challenge of our age” concerning global security and prosperity and was “increasingly authoritarian at home and abroad”. The leaders of the world’s largest economies criticised Beijing’s stance on issues such as Taiwan. But they also accused the country of “economic coercion”.

G7 countries called for a “de-risking” policy that would decouple their economies from China with diversified trade sources and protection on trade and technology.

Chinese stocks have suffered since April 18, when the country released figures on its first-quarter economic output. The Chinese market has lost $540 billion in value since then. Investors cut their exposure to the country after the previous tensions between the US and China. The Nasdaq Golden Dragon China Index and the Hang Seng have lost 5%, while the Chinese yuan has also lost around 2%.

Hong Kong Stock Market Forecast

“Investors remain sceptical about China for two primary reasons. First, the recovery has not been robust,” said Brock Silvers at Hong Kong-based Kaiyuan Capital. Another problem is the “fundamental investability,” which relates to political tensions.

Beijing needs to show more trust in foreign companies with a crackdown on international consultancies and an expansion of counter-espionage laws. That theme could last a while as the G7 increases its criticism of China. Large investment firms will likely refrain from investments in the UK.