EUR v AUD is feared by inflation numbers that could affect the price over the next two days.

The euro is looking to hold the 1.5400 support level but is facing core inflation numbers and Q3 GDP on Monday. That will be followed by an RBA rate hike decision ahead of Tuesday’s session.

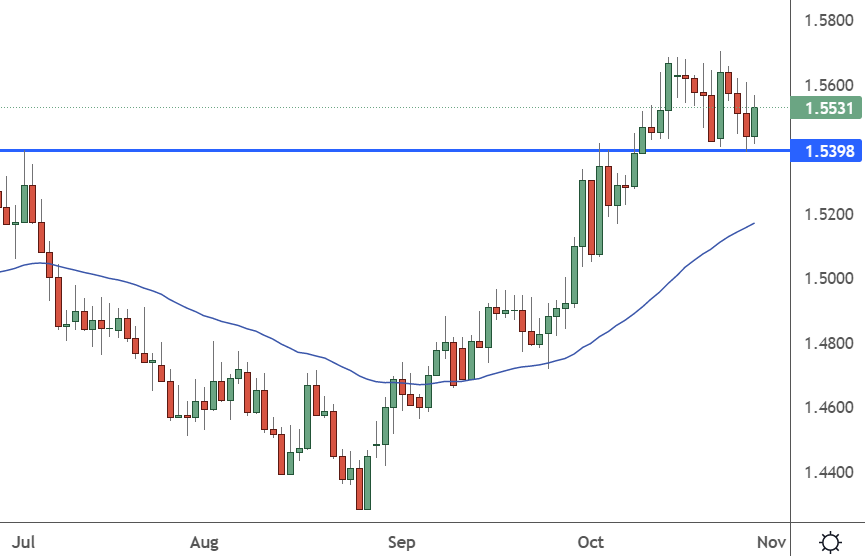

EURAUD – Daily Chart

The latest European inflation number is the core rate for October, with an expected 0.1% rise to the 4.9% level. The first estimates for GDP Q3 growth in the Eurozone are for a 0.2% quarterly GDP number. If inflation is higher or GDP is lower, the euro could drop against the Aussie dollar.

Ahead of Tuesday’s Asian session, the Reserve Bank of Australia is expected to raise rates by another 0.25% to 2.85%.

However, some analysts predict a 0.50% rate hike on Melbourne Cup day, when the country stands still to watch one of global horse racing’s most significant events.

Westpac Bank expects another 50 bps increase in the lending rate, but HSBC analyst, Paul Bloxham, disagrees. “I don’t think they will lift again in 50-basis point increments,” he said, adding that it would get “more complicated” after because the next meeting would be in February.

Westpac said: “Wednesday’s higher-than-expected inflation figures might have thrown a spanner in the works. However, it’s unlikely to be enough to throw the RBA off course entirely.”

“While it’s more likely the Board will stick with a standard quarter of a percentage point hike, the option of a double hike is very much a live one.”

“The global economy will start to rapidly slow by that point.”

Europe has been getting closer to a recession. The European Central Bank (ECB) raised interest rates to 1.5% last week, making borrowing and debt repayments more expensive. The ECB lifted its own interest rate after the latest inflation rate came in at 9.9%.

Macquarie Group said: “The sharply downgraded growth forecasts the ECB released just last month already look out of date and too optimistic … We expect the ECB will likely raise rates by another 100 bps in the next few months, pushing policy firmly into restrictive territory.”

The EURAUD pair should see volatility into Tuesday, which will determine the exchange rate path for the rest of the week.