Chinese stocks have remained under pressure this week, with a Thursday close at key support. A rally will be needed on Friday, or even Monday, to avert another sell-off.

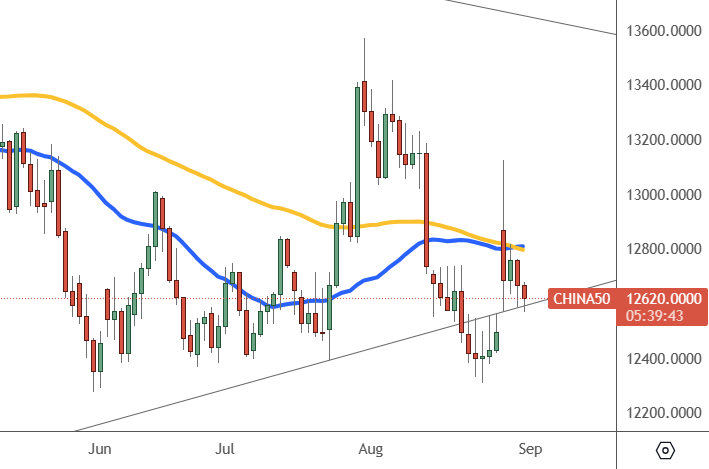

CH50: Daily Chart

Friday’s market closed at 12,620, with the 12,400 level as the next support target.

The market’s inability to rally investor sentiment is still cautious. While the recent stimulus measures are expected to boost trading activity, the economy’s growth woes are making investors hesitant to bet big on a quick turnaround. China’s local media has also urged investors to remain patient as the latest support measures work their way through the market, with the Securities Times saying they should not doubt recent moves.

Some investors say the nation needs to unleash a large stimulus package, like it did in 2008, to revive confidence. Foreign investors were buyers of onshore Chinese stocks last week, and outflows this month via the trading links with Hong Kong are poised to reach a record.

The stimulus is “technical in nature in terms of trying to improve liquidity for the stock market, and what’s needed is fiscal stimulus to boost the real economy,” said Xin-Yao Ng, investment manager of Asian equities at abrdn Asia Ltd. “The consensus among foreign investors is that a large stimulus from Beijing is required to improve consumer and enterprise confidence.

Recent moves are a “good start in terms of rebuilding confidence, but they are insufficient” for the short term, said Winnie Wu at Bank of America. “I think what investors are fundamentally concerned about is the economy. It is the fundamental problem in property, in LGFVs, in the private sector, and in employment.”