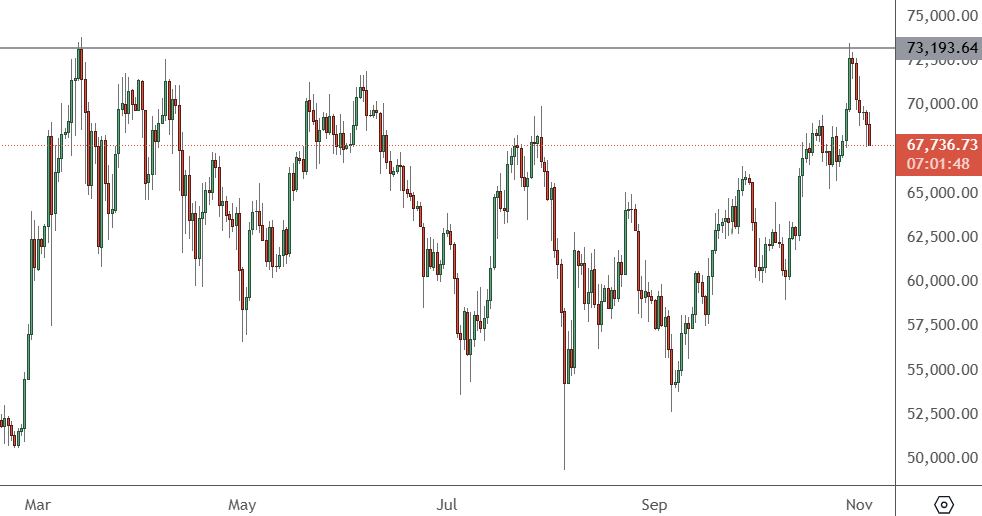

The price of Bitcoin has sold off after seeing resistance near the all-time high around the $73,000 level.

BTCUSD – Daily Chart

The price of BTCUSD has found resistance at the $73,193 level and may start a larger correction. Support is ahead before the $60,000 level.

Bitcoin is now becoming more dominant in crypto markets and is growing in importance against US Treasuries, the foundation of the American financial system. It is also a sign that some investors may be looking to take on extra risk in the search for larger returns.

Last week saw Bitcoin trading at a record 800 times the value of BlackRock’s iShares 20+ Year Treasury Bond ETF (TLT). That’s up from 466 at the time of Bitcoin’s previous high, in November 2021.

US Treasuries, which are backed by the credit of the government of the world’s largest economy, are considered among the safest assets in the world to own. They are also held by other global central banks as a safe store of value.

The absence of an incentive for price gains may be why the Bitcoin ETF, which has $60 billion in total assets, has lost 7% this year, while bitcoin has rallied 55%. The relative performance might be a signal that investors could be moving parts of their portfolio to bitcoin from longer-term Treasuries.

Bitcoin is also seeing investment grow as an alternative asset due to the availability of publicly-listed exchange traded funds, and with the huge success of the US-listed spot ETFs this year, bitcoin may be starting to emerge as a relatively safe asset for some global investors as economic uncertainty continues.