The investor Michael Burry has closed his short bets on the stock indices but taken new shorts, including against chipmaker Nvidia.

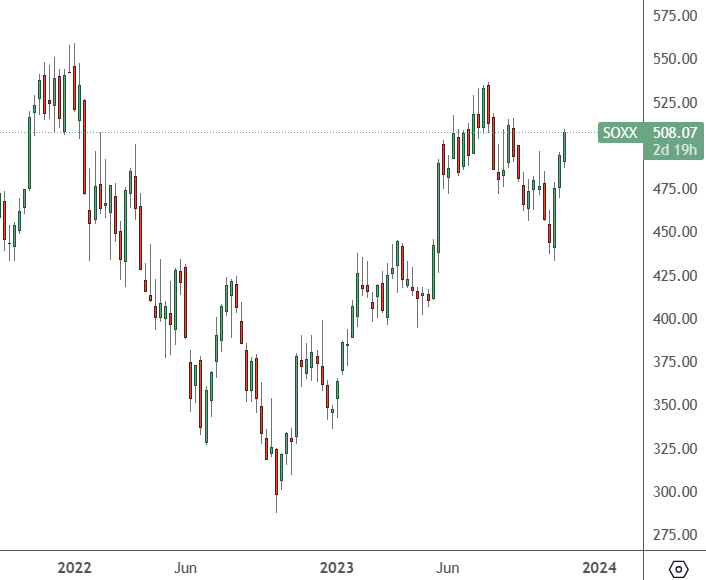

SOXX – Weekly Chart

The iShares Semiconductor ETF, which has the ticker SOXX, is up 43% year-to-date, while NVDA is up 234% year-to-date.

Burry’s Scion Asset Management purchased bearish put options on the SPDR S&P 500 and Invesco QQQ in the second quarter but closed them out with losses in his latest Securities and Exchange Commission filing. However, his firm did buy puts on 100,000 shares of Blackrock’s iShares Semiconductor ETF, valued at $47 million. He feels that some of the chip stocks are being pulled higher by Nvidia’s success.

The value investor changed his portfolio last quarter, slashing the number of positions from 33 to 13, more than halving its total value. Burry often overhauls most of his portfolio in a three-month timeframe. Burry also bought shares in Chinese e-commerce giant Alibaba.

The investor found fame after his massive bet against subprime debt in the housing bubble in 2007, which became a Hollywood film. Burry has also been critical of Tesla’s valuation and Cathie Wood’s Ark fund.

The investor is known for recent bearish warnings about US stocks in 2021 and again in 2022. Still, he has been unable to time another big short.

On Monday, Nvidia said its superior H200 chip is scheduled to come out next year and is expected to accelerate future AI models further. The company is coming from an unprecedented fiscal second quarter that saw year-over-year earnings grow 429%, with Q2 EPS at $2.70 per share, which was also a 147% increase from the previous quarter. Revenue growth has also soared with Nvidia’s Q2 sales at $13.5 billion, double the $6.7 billion the company brought in during the prior-year quarter.