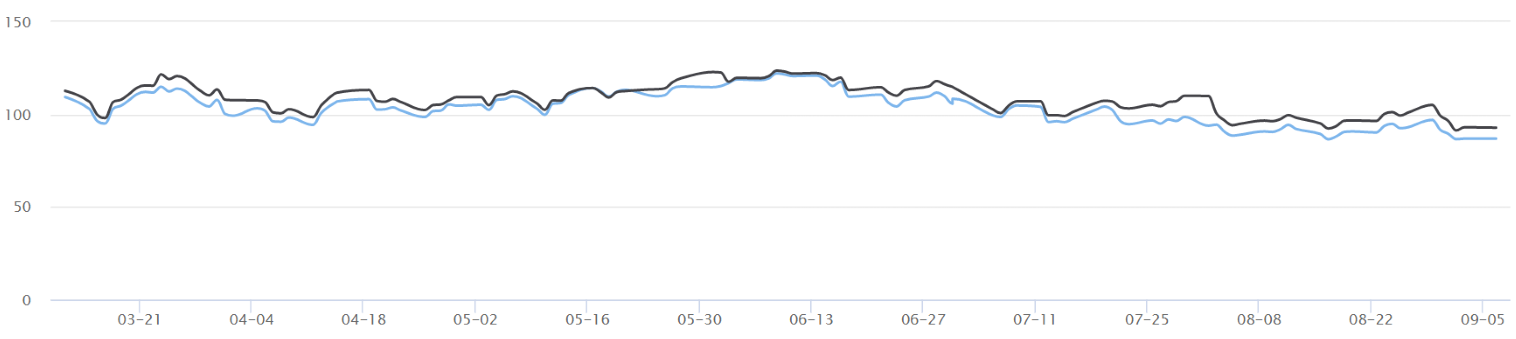

最近原油走勢非常波動,8月末布倫特原油曾一度衝高至102.95美元/桶,之後短暫回落。 9月2日至9月5日,WTI原油價格再度反彈,從86.56美元/桶上漲到88.60美元/桶,布倫特原油價格也從92.66美元/桶上升到95.13美元/桶。

隨後, OPEC+決定對全球經濟合計供應量將減少每日10萬桶,這項減產決定表示由於經濟衰退疑慮引髮油價下跌,OPEC+選擇通過小幅減產以提振油價。另外,本月即將迎來歐央行和美聯儲利率決議,如果兩個央行都選擇繼續大幅加息,那麼油價可能會持續處於承壓狀態,因為屆時經濟放緩的擔憂可能進一步上升,市場流動性也會進一步收緊。

由於原油價格的波動很大程度受到地緣政治和消息面的影響,在俄羅斯表示北溪天然氣管道一線仍將繼續關閉之後,歐洲天然氣價格已經暴漲近30%,“斷供”的消息將繼續推升歐洲的能源價格,對於油價來說是利好的一面。不過,油價潛在的下行因素仍然佔據市場主導,特別是伊朗方面可能恢復出口,但是目前來看,伊核談判的進度推進仍然緩慢,雙方立場存在分歧,最終是否達成協議還是未知數。

從早前鮑威爾的講話可以看出,需要在“一段時間”保持限制性措施的說法,也打消了市場上對放緩加息的猜測,隨著美元價格走高,以美元計價的大宗商品普遍受壓,這樣的趨勢可能還會短期持續。本週市場主要聚焦美聯儲主席鮑威爾的講話,以及即將公佈的反映美國經濟情況的褐皮書,對於原油投資者來說,需要尋找美聯儲放緩加息的可能時點,以期望利好油價回升。

即便是油價下行,預計下行空間較有限的,但中長期來說投資者也需要留意破位下行的可能性。從供應端來看,即便伊核協議達成,伊朗增產的量也難以彌補俄羅斯斷供的缺口,加上美國的石油庫存量也在不斷下降。冬季能源使用旺季即將來臨,供應端可能仍然會偏緊,市場擔憂能源供應危機出現也可能對油價提供支持。另外,OPEC未來也不排除再次減產提振油價,以應對全球需求放緩的擔憂,投資者需留意OPEC+預計在10月5日召開的會議。

因此,預計油價短期仍以震盪走勢為主,下行壓力佔據著上風,但短期預計幅度不會過大,除非在今年末證實原油供應過剩的情況大幅超過了預期。目前主要是需求端還存在較大的不確定性,加息對消費需求的抑制預計將是全方位的,現在還無法明確加息之後各國經濟可能衰退的程度,因此決定著下半年油價走向的仍然是全球主要經濟體的經濟數據表現。