美国非农就业数据低于预期,美元大跌,美股获得买盘

在最新的美国就业报告后,美元大幅下跌。对美国通胀将保持高位的担忧继续主导美元价格走势。美国供应管理学会(ISM)最新发布的服务业数据显示,美国经济增长放缓,物价上涨。服务业PMI降至两年来最低水平,而支付价格跃升至三个月高点。

由于下周欧盟缺乏重要的数据发布或事件,欧元将容易受到其他货币走势的影响。在英国,英国央行将于英国时间10日(周四)中午宣布其最新的政策决定,预计所有政策刻度盘将保持不变。投票模式可能会发生变化,更多的成员投票支持降息,这将削弱英镑。英国央行还将发布最新的季度通胀和增长报告。

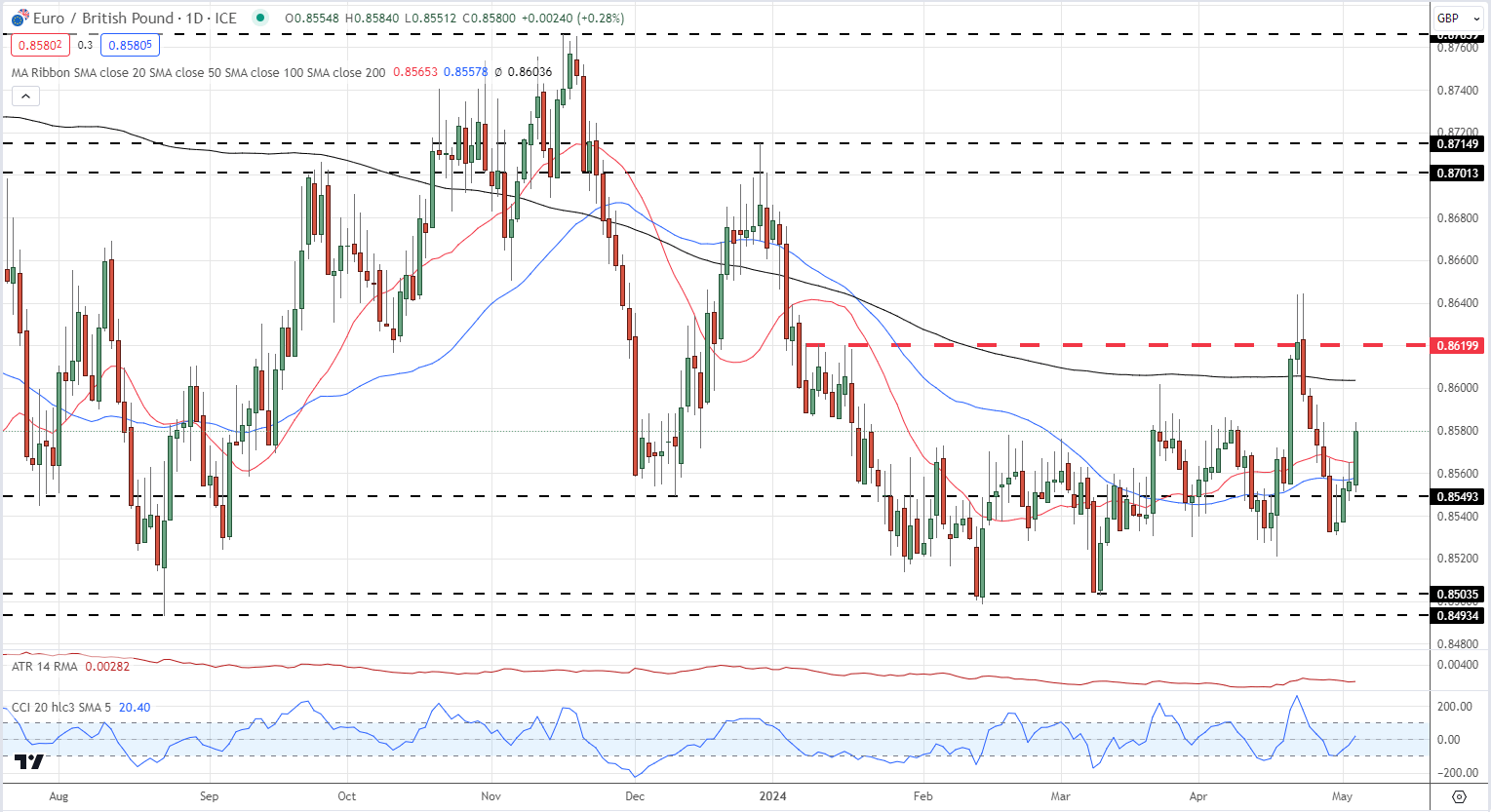

本周,欧元兑英镑收复了近期的部分失地,并突破了20日和50日移动均线。在200日移动均线切入0.8603之前,下一个阻力位是0.86。在此之上,支撑位为0.8620和0.8645。向下移动时,支撑位见于0.8550和0.8520。

欧元兑英镑日图走势

下周美国经济数据也不多。然而,在美联储决议和非农就业数据公布后,市场可以预期美联储会有一连串的讲话。欧元和美元的利差将继续受到密切关注,预计欧洲央行将在6月的政策会议上开始降息。

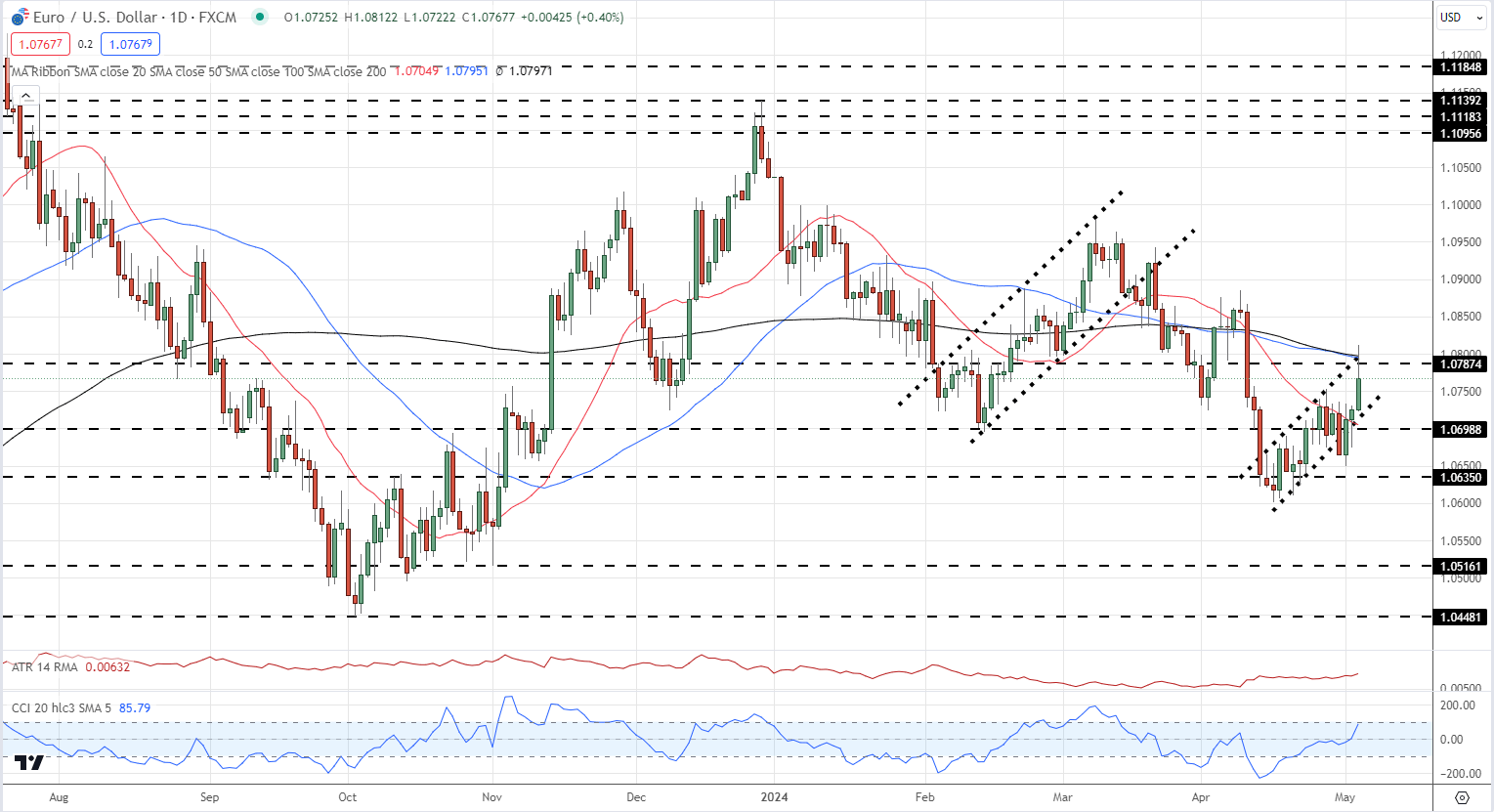

欧元兑美元仍处于上升趋势通道内,但如果该货币对突破趋势支撑位,这可能很快变成一个负面的空头信号。更低高点和更低低点的长期趋势仍然存在,跌破1.06被视为下一个负面信号。在此之前,趋势支撑位、20日移动均线和之前1.07左右的波动低点将作为一线支撑位。反弹将在1.0780和1.0795之间出现初步阻力,更高的阻力位于1.0885。

欧元/美元日图走势

零售交易者数据显示,47.54%的交易员是净多头,做空与做多的比例为1.10比1。净多头交易者的数量比昨天减少了9.02%,比上周减少了5.35%。相比之下,净做空的交易者数量比昨天增加了18.22%,比上周增加了17.35%。