Despite its recent debut in the market, the Reddit stock has already attracted sellers’ attention, hinting at a possible change in market sentiment.

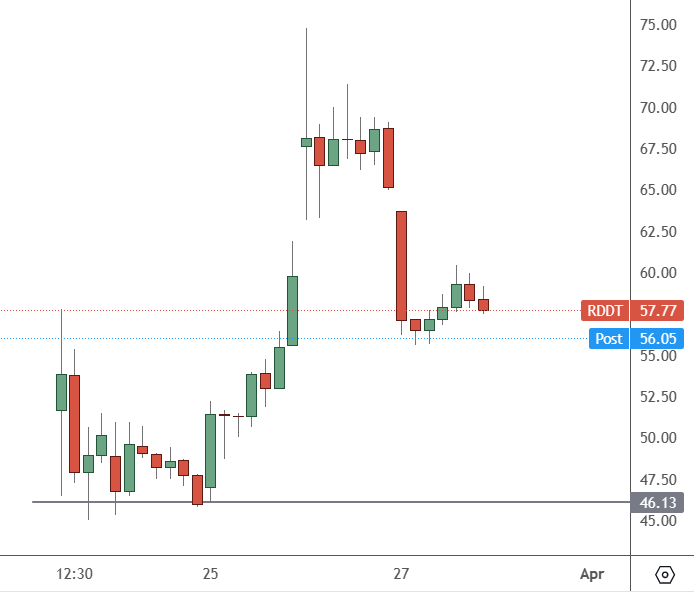

RDDT – Hourly Chart

RDDT hit a high near $75 and traded at $57.77, with support at $46.

Reddit (RDDT) stock faced significant pressure on Wednesday following a bearish report from Hedgeye. The research firm, identifying the social media firm as a short idea, deemed the recent rally as a factor that has left the stock’s price ‘overvalued.’ Hedgeye’s prediction of a 50% drop in the share price from its initial public offering (IPO) price is based on concerns over the company’s long-term expansion potential in international markets. This report echoes the trend of big-name IPOs in technology marking the top of a market, potentially leading to investors adding a meme stock tag to Reddit.

The meme resurgence goes beyond the recent IPO as GameStop (GME), the original meme stock, had its best one-day gain in a year. The Donald Trump-tied media SPAC finally launched under the name Trump Media and Technology Group with the ticker symbol DJT. That stock was up more than 50% during Tuesday’s trading session as criticism over the former President’s net worth now looks misguided.

“We are in a very exuberant market,” Interactive Brokers strategist Steve Sosnick told Yahoo. “We’re in a very momentum-driven market. One of the hallmarks of momentum is it becomes far less about fundamentals. It becomes all about price movement and much less about valuation. Meme stocks are the epitome of that.”

As the Bank of England recently warned, asset prices are at all-time highs and could be in for a sharp correction. Reddit is a prime example, as is another IPO that lands just in time for a market top.

Meanwhile, the collapse of a Baltimore bridge could create supply problems and bottlenecks. Manufacturers and shippers are trying to find where to load or unload cargo. Supply chain experts say other ports up and down the East Coast will likely absorb much of Baltimore’s traffic, avoiding a crisis, but only with some upheaval.

“Ultimately, most trade through Baltimore will find a new home port,” Moody’s Analytics economist Harry Murphy Cruise said.