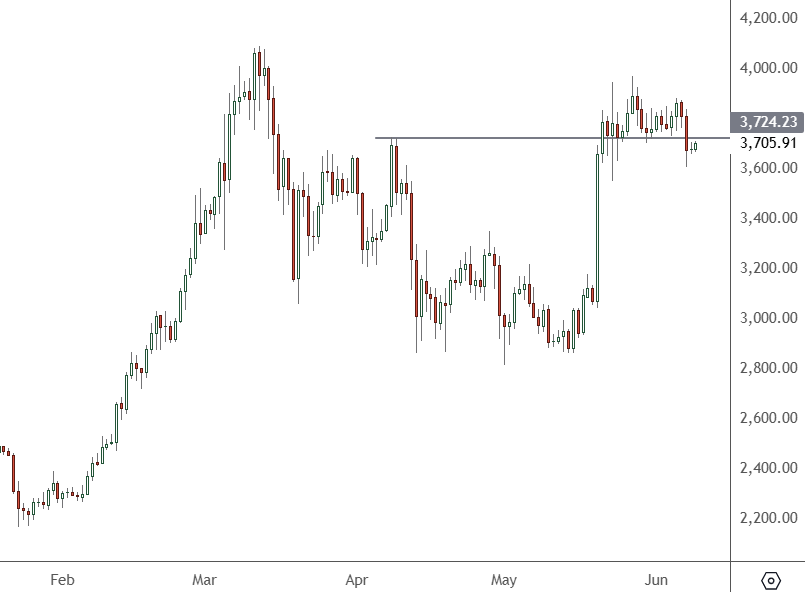

Ethereum could face a pivotal week after resistance held on Friday.

ETHUSD – Daily Chart

ETH fell back through the $3,700 level and is holding that with quiet weekend volume. Any further selling could erode some of the ETF-driven gains from $3,000.

Stock markets stalled on Friday as traders saw the chance of US rate cuts disappearing with solid data.

Bitcoin’s Exchange Traded Fund inflows were at their second-highest level this week, but that has not led to price gains.

A 40% drop in meme stock GameStop soured the mood in crypto and other speculative assets. BTC was dragged lower through the $70k level, with the all-time highs above $71,000 proving stubborn.

On Thursday, spot ETFs completed their 18th consecutive day of inflows, higher than the frenzied price increases of February and March. Over the recent 18-day streak, Bitcoin ETFs accumulated more than 56K bitcoins, according to HODL Capital, or almost 7x the amount of bitcoin mined during that period.

That has not led to a breakout, but some analysts are still optimistic about BTC’s chances.

“Looking at the current market positioning, I don’t think things are anywhere as frothy as they were in late March/early April,” Greg Magadini of Amberdata said in a weekly newsletter.

“We can clearly see that the futures basis is much lower than around peak positioning and the underlying open interest is rather stable for BTC,” Magdini added.

That will likely depend on how stocks perform as markets readjust their hopes for an early rate cut in 2024. But that also leaves the market vulnerable to any bad news.

The European Central Bank and Bank of Canada have already begun lowering their benchmark rate. However, their economies are weaker than those of the United States.

The newsletter from LondonCryptoClub also said oil price weakness could help Bitcoin because oil is a significant indicator of future inflation and could lower bond yields.

US stocks are hovering near all-time highs to start the week, and they could guide crypto prices this week. Any weakness could see a correction in BTC/ETH that drags on the broader crypto market.