Apple’s stock has continued downward since the US Department of Justice announced an antitrust action against it.

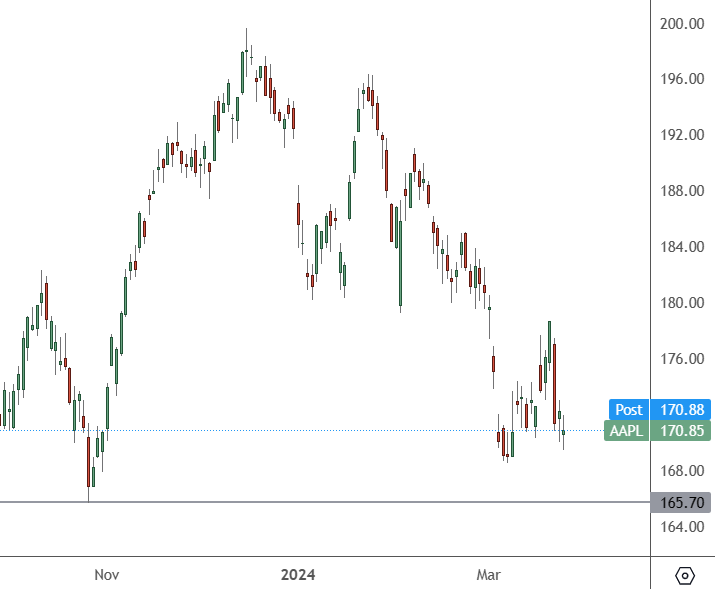

AAPL – Daily Chart

AAPL was lower at $170.85 after news of the lawsuit and looks on course to test the $165.70 support from 2023.

The US DOJ and 16 state attorneys general are suing Apple for violating antitrust laws, which caused the stock’s value to drop by $115 billion in a day last week.

Bloomberg said, “The US lawsuit alleges that Apple has used its power over app distribution on the iPhone to thwart innovations that would have made it easier for consumers to switch phones. The company has refused to support cross-platform messaging apps, limited third-party digital wallets and non-Apple smartwatches, and blocked mobile cloud streaming services, according to the DOJ.”

The European Union recently fined Apple $2 billion for preventing Spotify and other music streaming services from being removed from its platforms. That also included changes to Apple’s operating systems and platforms, including allowing third-party app stores and making Apple provide support for external third-party payment platforms.

However, the DOJ antitrust lawsuit could be more expensive and have more significant repercussions.

Consumers would benefit from a more open ecosystem, allowing users more choices, including access to alternative app stores and apps outside Apple’s selection. On the downside, it could make Apple’s user experience less secure with the threat of malware from third-party apps.

Wedbush Securities analyst Dan Ives is bullish on Apple stock. He currently has an Outperform rating and a $250 target price, which would be a 46% gain. However, he also sees the risk of Apple’s “core business model.”

“The key part of the DOJ case will likely argue that Apple unfairly penalises competitors and tech rivals by blocking other tech players from accessing hardware and software features of its flagship iPhone,” Ives wrote in a note to clients.

Ives also believes that Apple will ultimately have to settle, which could see a hefty fine above $2 billion and some changes to the App Store.

With the stock under pressure, support from the 2023 levels, at around $165.70, will likely be the following path forward.