Tech creator firm Adobe releases its latest earnings on Wednesday after a strong year in 2023.

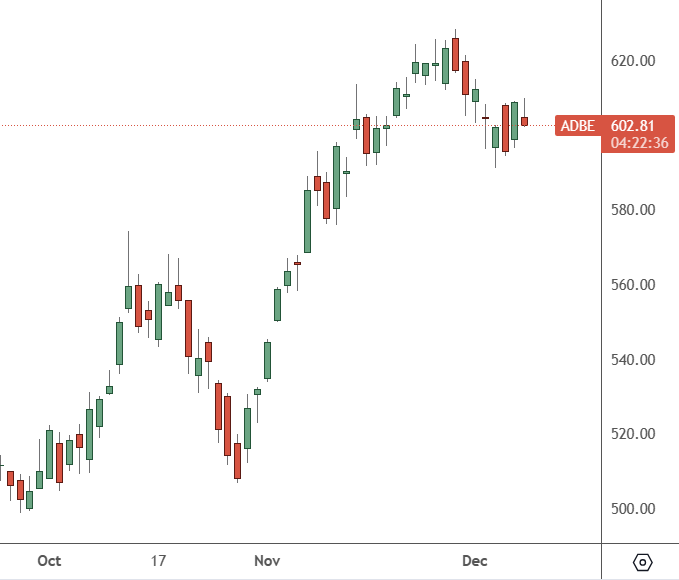

ADBE – Daily Chart

ADBE is up 77% year-to-date but has seen some resistance around the $630 level. The support levels could take the stock to $560 or lower with a weaker stock market.

The company beat Wall Street estimates for its fiscal third quarter. But the outlook for the current period has said that earnings would only be modestly higher than views on in-line sales.

The San Jose company said that in the third quarter, it earned $4.09 a share on sales of $4.89 billion. Analysts had expected Adobe earnings of $3.98 a share on sales of $4.87 billion. On a year-over-year basis, Adobe earnings rose 20% while sales advanced 10%.

For this week’s fourth-quarter earnings, investment bank JP Morgan said the focus would be on the year-ahead expectations.

Analyst Keith Weiss at the firm has an overweight rating and a $660 price target on Adobe shares and said it looks as if investors are “very comfortable” with the company’s ability to monetize artificial intelligence.

However, questions surround the company regarding guidance for Digital Media revenue and Firefly adoption, so the company’s margins will be significant.

On Digital Media, Adobe is likely to give forward guidance of around $2 billion in net new revenue, partly driven by recent price increases, growth from Express, and the early adoption of Firefly. At a recent investor day, generative AI showed it could be a “better tie together” of the processes involving Digital Media and Digital Experience.

Weiss added that the crucial margins are expected to remain in the mid-40s despite the company going into an investment cycle.

“Bottom line, we continue to see the potential for upside to current FY24 consensus estimates across Digital Media, Digital Experience, and EPS, which should sustain momentum in ADBE shares”.

For the fourth quarter, estimates are for $4.14 per share on $5.02B in revenue. The forward guidance is expected to show earnings of $17.89 per share, up from $15.93 per share for fiscal 2023.

With the bull market under threat of a correction, investors should pounce on weakness in the stock as many things are well priced in.