The EURUSD exchange rate should have activity on Wednesday with economic data releases.

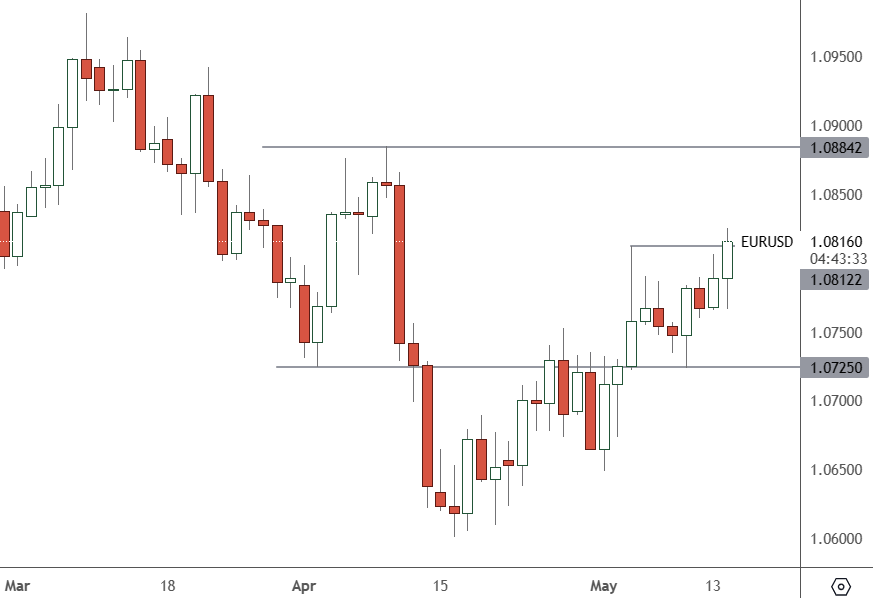

EURUSD – Daily Chart

EURUSD is looking to press ahead of the 1.0816 resistance level. The next target above is 1.0884. Support will be at 1.0725 again if the price reverses lower.

EURUSD has growth figures released for the European economy on Wednesday. The data released at 5 pm HKT is a second estimate but will still have a factor in the price of the pair over coming days. The second quarter figure is expected to be -0.1% for the Eurozone.

The ECB’s Klaas Knot, a voting member, said June is a good time for the first rate cut from the central bank.

The big data release is the latest US inflation reading, which will come at 8:30 pm HKT, but it will be a driver for the price for the remainder of the week. Analysts are expecting to see a dip in inflation to 3.4%. A higher figure would be bearish for stocks and currencies. A slowing in inflation would confirm expectations for a September rate cut.

Retail sales will also be released with the expectation for a slowdown over the month from 0.7% to 0.4%.

Tuesday saw the release of business inflation with the Producer Price Index coming in higher than expected. The latest figure was 0.5%, up from 0.3% and another sign of stubborn inflation in the US The number was the highest Y-o-Y read since April 2023 and is the fourth consecutive increase over expectations.

“The CPI tends to have a bigger short-term impact on the markets, so the picture could look much different 24 hours from now. But if the CPI also comes in above expectations, the interest rate picture may be thrown into doubt,” said Chris Larkin at E-Trade.

“This report underscores Fed concerns that the path of disinflation has stalled, requiring a higher-for-longer policy stance to combat seemingly entrenched inflation. An overriding question — and potential dilemma — hovering over markets is whether the broader economic landscape is softening at the same time inflation inches higher, making the Fed’s job increasingly difficult,” analysts at LPL Financial said.

The big data release is now Wednesday’s inflation reading which will define the path of the EURUSD for the week ahead.