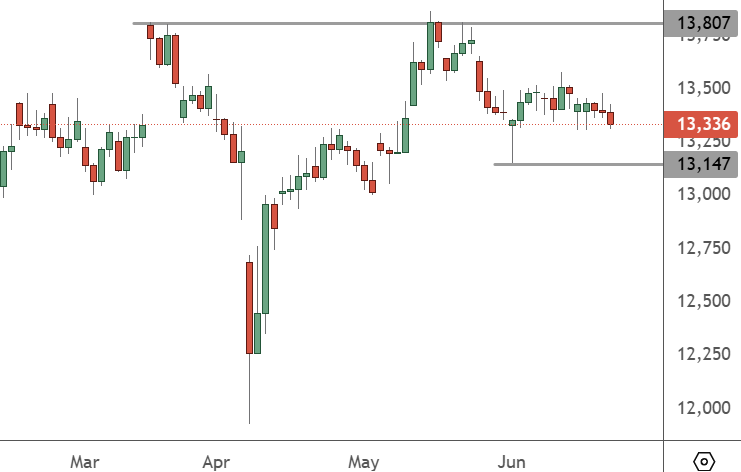

Chinese stocks remain in consolidation mode with a possible test of recent support ahead of any further upside.

The price of the China 50 has a bearish tone as it hovers above the 13,147 support. That level may be questioned again before any move higher.

Markets are braced for the investor reaction to a Trump attack on Iran. Some may see it as an end to the problems in the Middle East, but others are not so sure.

Foreign investors started the year with bets on onshore Chinese stocks as they expected Beijing to add more market stimulus. Six months later, the weaker economy has hurt the onshore market, with the Hang Seng China Enterprises Index beating the CSI 300 Index by nearly 20% in 2025, which is on track for the largest annual outperformance in twenty years.

Analysts at Julius Baer Group and Morgan Stanley are expecting the Hong Kong market to continue leading the way. Mainland investors have added almost $90 billion to Hong Kong stocks this year, which is 90% of the 2024 total.

The sector spread in Hong Kong “is also becoming more comprehensive with recent listings and upcoming IPOs,” said Richard Tang at Julius Baer. “H-shares are likely to continue outperforming A-shares driven by global rebalancing flows and strong Southbound flows,” he added.

The China 50 index may continue to see the same trend unless domestic investors can see a reason to get more involved. Many are still cautious after the fallout of the property sector.

There was some hope for the consumer market last week as China’s retail sales jumped by 6.4%, for the largest market surprise since 2023. Recent data also suggests that China will meet its growth target this year, according to ING.

“Despite the slowdown, year-to-date growth remains quite solid at 6.3% YoY, and industrial activity has somewhat surprisingly remained a growth driver through the first half of the year,” they said.