日圓延續跌勢,週三將美元兌日圓匯率推至九個半月新高。美元兌日圓的上漲反映出日本政府要求央行維持寬鬆貨幣政策的壓力越來越大,掩蓋了可能升息的訊號。

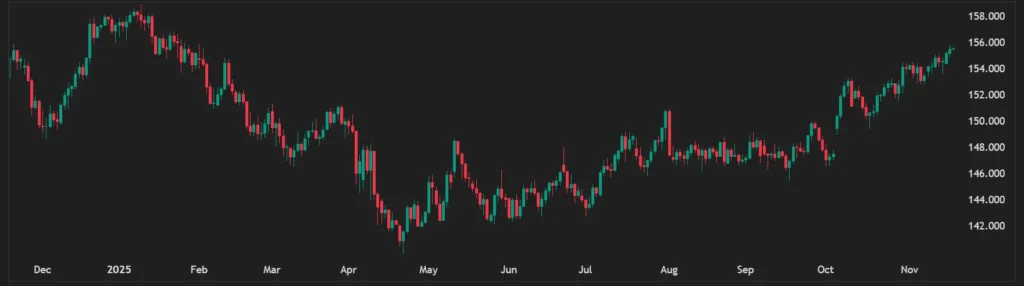

美元兌日圓-走勢圖

在亞洲早盤交易中,該貨幣對升至155.50日圓附近,這是自1月底以來高點。這一動向突顯出日本和美國之間貨幣政策預期的差距正在擴大,投資者正在等待聯準會最新會議紀要的發布,以尋找有關美國利率走勢的進一步線索。

儘管日本央行總裁植田和男暗示最快下個月可能升息,但日圓在美元兌日圓匯率內仍出現下滑。然而,他的言論遭到了日本首相高市早苗的公開反對。高市早苗敦促日本央行維持低利率,以支持政府的通貨再膨脹努力。

高市一的干預加劇了市場對日本央行可能被迫放慢政策正常化步伐的預期,這一前景繼續嚴重拖累日元,並支撐美元兌日圓。

在太平洋彼岸,由於交易員縮減了對聯準會今年大幅降息的押注,美元得到了支撐。包括副主席菲利普•傑斐遜在內的幾位聯準會官員發表的鷹派言論,提振了美元。傑佛遜表示,聯準會應「緩慢」推進進一步降息。

最近的美國勞動市場數據突顯了美國經濟的彈性。截至10月18日當周初請失業金人數為23.2萬人,而ADP Research的另一份報告顯示,在截至11月1日的四周內,雇主平均每週僅裁員2,500人。

兩家央行面臨的不同壓力凸顯了經濟前景的差異,聯準會仍處於「更長時間內更高」的持有模式,而日本央行正在微妙地退出其長期以來的超寬鬆政策,這一動態繼續推動美元/日圓。