週三備受市場關注的美國7月零售銷售月率,市場預計值為0.10%,其前值為1%。這項數據對於指引美元接下來的走向至關重要,反映出在通脹壓力之下美國零售銷售和經濟表現的情況。若這項數據表現好於預期,會令到市場對經濟衰退的擔憂有所緩解,有利於提振美元;反之,則可能會拖累美元。

另外,本周有多家零售巨頭公佈今年第二季度的財報,市場主要聚焦消費的表現。在本週二,沃爾瑪和家得寶公佈了今年第二季度財報,沃爾瑪二季度營收1528.6億美元,同比增長8.4%,優於預期。週三,塔吉特和Lowe’s會公佈第二季度財報。不過,沃爾瑪和塔吉特早前都已下調第二季度盈利指引,其中沃爾瑪預計全年調整後每股收益預計下降約11%-13%。

這也反映出通脹正在改變著美國消費者的選擇,也對零售銷售行業不斷帶來衝擊,不少消費者選擇削減開支,同時增加花費在食品上的支出,令他們對於其他商品的消費有所下滑。所以在這期間,零售巨頭都面臨這需要清庫存的局面,加大打折促銷的力度也會令到其銷售收入受到影響,加上燃料和貨運成本的上升以及供應鏈面臨壓力,對銷售收入形成負面影響。

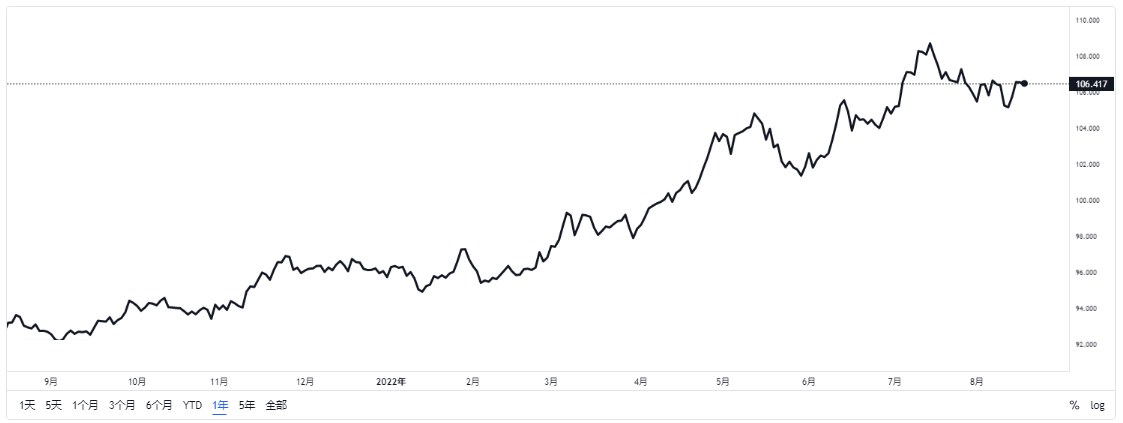

由於汽油價格明顯較之前回落,令零售銷售可能較上個月出現回落,加上美國整體7月通脹CPI同比上漲8.5%,低於預期的8.7%和前值9.1%,放緩超過預期,其中能源和商品價格均下跌,這可能令到9月加息會有所降溫的預期增加。據CME“美聯儲觀察”預計,美聯儲到9月份加息50個基點的概率為61.5%,加息75個基點的概率為38.5%。

對於美元走向來說,當前還存在較多不確定性,直到9月利率決議出爐之前美元預計會相對波動,尤其是不少官員近日發出鷹派言論,認為與通脹的鬥爭還沒有結束,令美元一度重試上升動力。多位官員表達了繼續積極收緊貨幣政策的堅定決心,幾乎所有官員都一致表示,美聯儲仍決心繼續加息,“直到看到強有力且持久的證據表明通脹正在放緩”。

官員們的發聲也支撐了近日美元走向趨好,市場目前仍在靜待本週四美聯儲會議紀要的出爐,投資者可能會從中尋找到對於未來加息週期的信息,如果美聯儲會議紀要中開始談及放緩加息步伐的可能性,美元可能會因此承壓,但是如果美聯儲政策的方向維持不變,美元相反可能會迎來新的上漲機遇。

零售銷售亦是本週左右美元發展的重要因素之一,需和市場對加息的預期結合起來綜合考慮對美元走向的影響。此外,也要密切留意各大零售巨頭財報數據的公佈,其可能會為近期零售股帶來新的行情,甚至可能會對大市走向和消費者信心帶來影響。