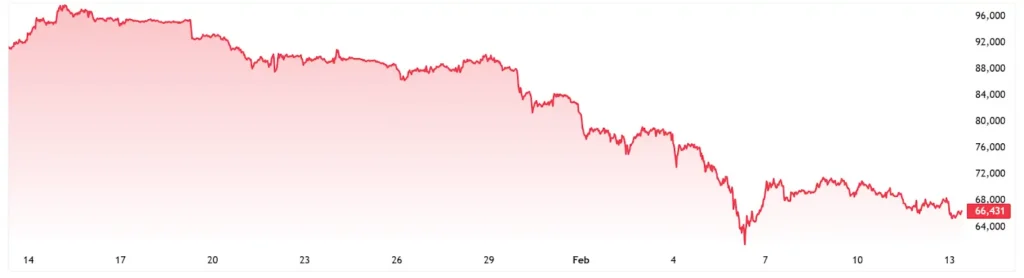

Why Did Bitcoin Drop After the US Jobs Report?

Bitcoin fell 2.9% on Thursday to $65,663 (as of 15:18 ET). This extended a four-day losing streak amid a risk-off mood across assets. A stronger-than-expected US January nonfarm payrolls report showed robust job growth, steady low unemployment, and firm wage gains. It dashed hopes for near-term Federal Reserve rate cuts. Traders now price in easing only by June, pressuring risk assets like crypto. Bitcoin stabilized overnight but could not sustain gains. It stayed range-bound below $70,000 after halting a slide toward $60,000 earlier this month.

Crypto Market Data: ETFs, Derivatives, and Volatility

- ETFs: Spot Bitcoin ETFs saw $276.3M net outflows on Feb 11, led by Fidelity’s FBTC ($92.6M redemptions). WisdomTree’s BTCW added $6.78M. Total ETF assets: $85.77B (6.35% of BTC market cap). Cumulative inflows: $54.72B.

- Derivatives: Open interest dropped to $23B (well below Jan/Oct peaks). Low open interest-to-volume ratio shows flushed leverage. Funding rates slightly positive. Inverted implied volatility signals near-term uncertainty.

- Analyst View: “Total crypto market cap remains range-bound with subdued volatility and limited conviction,” says Nexo Dispatch’s Dessislava Ianeva.

Higher-for-longer rates typically hit crypto hard. Thursday’s higher-than-expected jobless claims added caution. Friday’s CPI report is now key for clues on Fed policy.

Standard Chartered Bitcoin Price Prediction: $50K Low Ahead?

Standard Chartered slashed near-term forecasts, citing “challenging” price action. Analyst Geoff Kendrick expects:

- Bitcoin to $50K or below.

- Ethereum to ~$1,400.

Reasons: ETF holdings down 25% from Oct 2025 peaks (nearly 100K fewer BTC coins). An average buy price of ~$90K puts investors in deep unrealised losses, fueling sells over dips and dip-buying. Long-term: Recovery expected for the rest of 2026 post-lows.

Bitcoin’s struggle reflects cautious appetite amid volatility. Watch CPI for breakout signals.

BlockFills Halts Withdrawals: What It Means for Crypto Liquidity

Crypto liquidity provider BlockFills paused client withdrawals last week amid the slump, per FT and other reports.

- Details: Protects clients and the firm under stress. Spot and derivatives trading continue to be limited.

- Scale: Serves 2,000+ institutions. $60B+ volume in 2025.

This echoes past downturn moves by crypto firms, signalling liquidity strains.