The USDJPY exchange rate has the latest Japanese inflation data ahead of Friday.

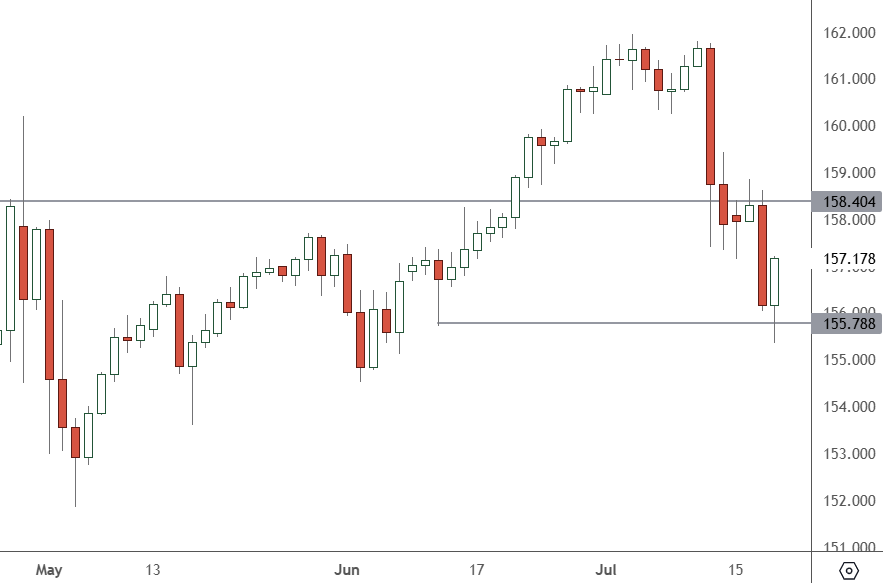

USDJPY – Daily Chart

USDJPY found support on Thursday at the 155.78 level, which will be essential in the future.

Japan’s inflation data was 3.3% a year ago but slipped to 2.2% in January. However, the data has crept higher to 2.8% in May. Another push higher in June’s data could push the USDJPY lower.

The other factor affecting the exchange rate has been the recent intervention by the Bank of Japan. The BOJ has shown that the line in the sand for dollar gains is around the 160 level. Any gains toward that level are unlikely to see institutional solid buying due to the fear of sharp losses.

The US dollar weakened on Thursday after the economy saw higher unemployment data. Dovish comments from Fed official Austin Goolsbee also hurt the dollar. He said that the central bank is closer to cutting interest rates. He warned that it risks a recession if officials delay any changes to monetary policy for too long.

He did not give an exact timeline for a potential rate cut, but when asked if the Fed has the basis to do so now, he said, “Are the conditions in place here? Yes, this is what the path to 2% looks like.”

“It’s not done, but it makes me feel a lot better when you both see it for multiple months in a row,” he said of inflation.

Japan’s economy has shaken off a prolonged deflationary period, and comments from the BOJ could hint at changes to its monetary policy. The central bank has said the economy is progressing on wage hikes and 2% inflation.

“Many regions reported that big firms’ big pay hikes in this year’s wage negotiations were spreading to small and medium-sized companies,” the BOJ said.

The latest assessments contrasted with the previous meeting in April when the BOJ said there were “hopeful signs” that solid wage increases among big companies would spread to smaller firms.

A higher inflation number on Friday could spook investors into selling the USDJPY.